HOW SINGAPORE CAN BE A MAJOR BENEFICIARY

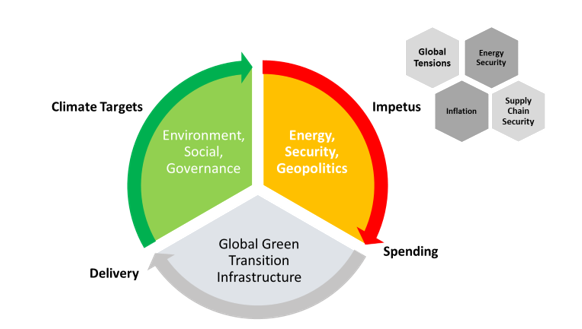

1. ESG, or “Environment, Social and Governance”, has been at the forefront of the global agenda as countries continue to commit to Climate Change. The reality of implementing change is being shaped by the need for Energy Transition, Energy and Supply Chain Security, as well as domestic and global Geopolitical considerations. This New ESG – “Energy, Security and Geopolitics” – are the global thematics that would most likely determine how real capital is allocated into developing the new green infrastructure for this decade.

2. Our previous articles outlined two of the three main areas of growth that the Singapore equity market can benefit from in this coming decade, namely:

- The benefits of technological diffusion to improve service delivery in the business-to-business spacThe benefits of technological diffusion to improve service delivery in the business-to-business space. (Singapore Market Outlook 2023)

- How the Singapore real estate and banking sector role as a safe haven is elevated amidst global uncertainties. (Riding on Global Megatrends – Singapore Equities in a new era of De-Globalisation and Geopolitical Uncertainty)

3. This article will elaborate on the third pillar of growth for the Singapore Equity market, which is how industrial companies in Singapore can ride the Global Megatrend of the Green Energy transition to build and invest in the renewables grid regionally and globally. Underpinning this global Green Energy transition is the shift towards the “New ESG”.

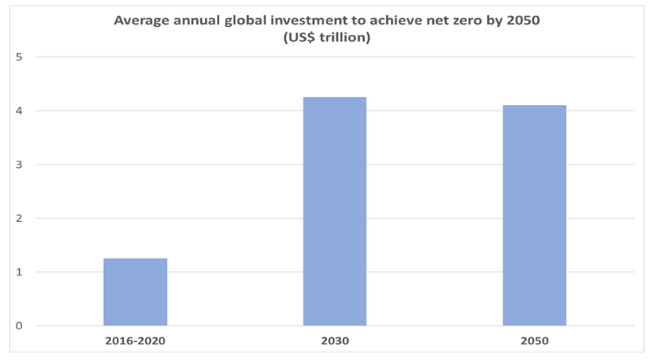

4. The “New ESG” arises from the need to bring the aspirational targets of the Climate Change agenda into reality. However, transforming from a fossil fuel based global economy towards one with more renewable energy is expensive, requiring large capital expenditure and tax subsidies that may have to be borne by taxpayers who have been already suffering from high inflation.

Source: Institute for Energy Economics and Financial Analysis, Sep 2023

5. Conveniently, the narrative of “Energy Security” offers democratic electorates around the world an impetus to deficit spend, even amidst high inflationary conditions. The need for energy security, a geopolitical imperative founded on rising global tensions, helps to bring the conservative right with the ideological left towards the same goal of committing to large scale government spending to develop new renewable energy infrastructure.

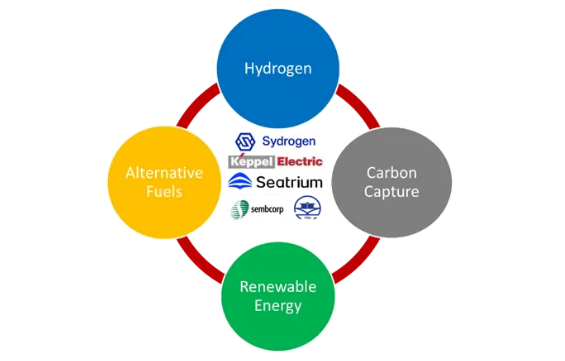

6. Industrial firms in Singapore, comprising of those in the marine engineering, utilities, and basic materials space, are well positioned to capture the global revenue opportunity for Green and Energy Transition Infrastructure. These firms have pivoted into Renewable Energy such as wind and solar energy, and are also exploring new growth areas in Hydrogen, Carbon Capture, and alternative fuels like Methanol and Ammonia.

Schematic: Illustration of the industrial firms pivoting into green and transition energy infrastructure.

References to specific corporations/companies and their trademarks are not intended as recommendations to purchase or sell investments in such corporations/companies nor do they directly or indirectly express or imply any sponsorship, affiliation, certification, association, approval, connection or endorsement between any of these corporations/companies and Lion Global Investors Limited or the products and services of Lion Global Investors Limited.

7. As geopolitical tensions intensify, Singapore firms can continue to attract global demand seeking a neutral supply chain jurisdiction. Given the global revenue reach of the industrial firms in Singapore, as well as the large total addressable market that Green and Transition Energy offers, the industrial sector is poised to become one of the major pillars of growth in the Singapore equity market in this decade.

LIONGLOBAL SINGAPORE DIVIDEND EQUITY FUND

The LionGlobal Singapore Dividend Equity Fund aims to provide investors with regular distributions and long-term capital growth by investing primarily in high and/or sustainable dividend yielding equities (including real estate investment trusts, business trust and exchange traded funds) listed on the Singapore Stock Exchange (Mainboard and Catalist) or listed outside of Singapore.

Amidst geopolitical tensions and high inflation, Singapore’s industrial sector has done well. We like long-term structural growth themes including Energy Transition, Energy and Supply Chain Security that support infrastructure development. In the near term, concerns over global recession would weigh on global equity market performance, which could present an attractive entry point for the Singapore market.