The Russian invasion of Ukraine in March 2022 is likely to usher a new period of volatility and uncertainty in geopolitics. Major reactions have been taken, such as the European Union planning to jointly issue bonds to finance energy security and defense spending1 in a move that sets the tone for de-globalisation, protectionism and the re-shoring of supply chains. With territorial disputes in the South China Sea still simmering, the cementing of allegiances between the United States of America and its western allies through this crisis in Ukraine could set the stage for potential geopolitical escalations in time to come.

Amidst uncertainty, Singapore’s standing as a safe haven stands out. As the pre-eminent British rule of law-based financial hub in the Asian region with a triple-A sovereign rating, Singapore is well-positioned to continue to attract financial flows seeking stability. We can observe this flow on a few levels:

a. Singapore is a leading hub for wealth management flows, with 25% of Family offices in Asia located in Singapore compared against 20% of offices located in Hong Kong. Globally, 24% of Family Office leading professionals rank Singapore as the number one hub for family offices2.

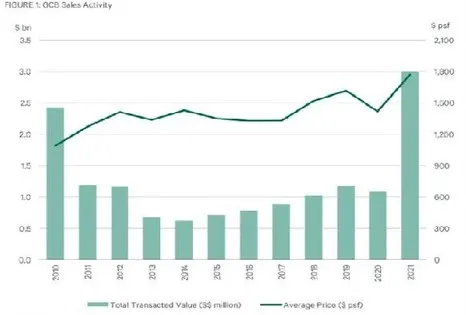

b. In terms of physical real estate, sales of Good Class Bungalows in Singapore reached a new high in 2021. According to real estate broker CBRE3, strong sales in this segment was boosted in part by continued demand from new citizens. This reflects the attractiveness of Singapore as a destination for long term global wealth willing to store value in the form of illiquid assets such as real estate.

Source: CBRE Research, March 2022

c. In terms of talent pool, The Straits Times reported on 17 March 2022 that immigration services firms and international schools have seen an increase in enquiries from expatriates living in Hong Kong looking to make a transfer to Singapore.

1Source: Bloomberg, 8 March 2022

2Source: Agreaus Group, 2021 “ A Focus on Family Offices in the Asia Pacific”

3Source: The Business Times, 14 March 2022

Source: The Straits Times, 17 March 2022

Banking stocks benefit from rising interest rates. This is because as interest rates rise, bank earnings increase as they are able to earn more from interest income. As an indication, the Singapore benchmark 5-year yield has increased from 1.3% to 2.3% over the first quarter of 2022. Over the same time period, the three listed local banks (DBS, OCBC, UOB) have experienced share price increases of between 8% -20%.

In addition to being beneficiaries of rising interest rates, banks can also benefit from a structural increase in asset base as Singapore continues to attract financial flows as a safe haven. This means that the banks can earn fees and interest income across a larger pool of assets, in terms of higher loan growth as well as increasing wealth management business.

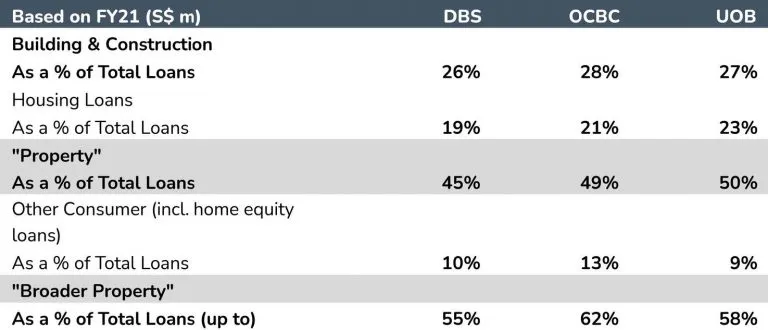

Based on 2021 figures, about half of loan exposure of the three local banks is related to property and construction. Hence, banks stand to grow their loan books amidst robust demand for property.

Source: Citigroup, Annual Reports of DBS, UOB and OCBC, March 2022

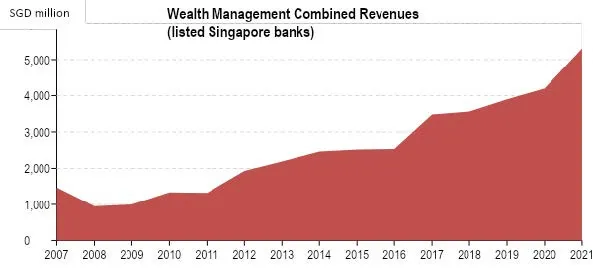

In addition, banks also stand to benefit from rising wealth management inflows. As seen from the chart below, wealth management-related fee income amongst the three local banks has been growing strongly over the past decade.

Source: Citigroup, Annual Reports of DBS, UOB and OCBC, March 2022

As an important component of the Singapore stock market, the banking sector is poised to anchor the performance of Singapore equities amidst geopolitical uncertainty.