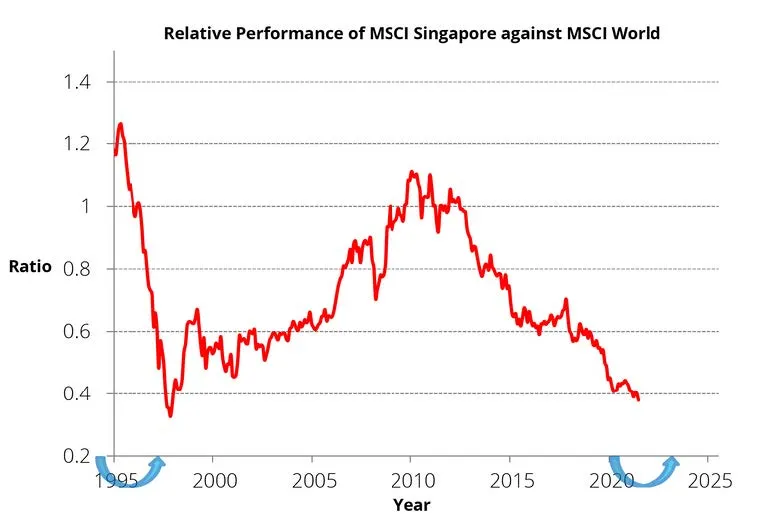

In our January 2021 market outlook, we observed that The Singapore equity market could possibly be at a once-in-a decade positive inflection point. We believe this continues to be the case. This is best illustrated graphically. The chart below shows the relative performance of the Singapore market to global equities over the past 30 years. This chart shows that whilst Singapore equities have underperformed global equities for the past 10 years, we are now at a low level not seen since the Asian Financial crisis. We could see a bottoming of this underperformance, since corporate balance sheets in Singapore are in far better shape now than in 1998.

Figure 1: MSCI Singapore Index / MSCI World Index

Source: Bloomberg, Lion Global Investors, December 2021

Indeed, Singapore equities have the potential to begin to outperform global equities over the next decade. From a bottom-up perspective, we believe that there are a few megatrends that can enable Singapore equities to outperform global equities in the decade ahead. We will elaborate on one of this: how the cycle of technological diffusion can benefit companies in Singapore, especially those companies that we label as “Blue Cheaps” opportunities.

The Cycle of Technological Diffusion

Over the past 10 years, technology companies such as Google, Amazon, Tencent and Tesla have benefited from developments in computing, Big Data and Artificial Intelligence. Whilst the convergence and maturation of technology streams have played a key role in enabling these companies to generate outsized returns, the macroeconomic backdrop has also played an important role in supporting the growth of these companies.

Figure 2: Decade of Quantitative Easing (QE)

Source: Lion Global Investors, December 2021

The decade of Quantitative Easing (QE) since 2009 has lowered interest rates, enabling technology firms to access cheap sources of capital and even government subsidies in the case of the electric vehicle sector. By spending aggressively on customer acquisition, these are “able” companies buy demand to drive consumers to adopt the new technologies.

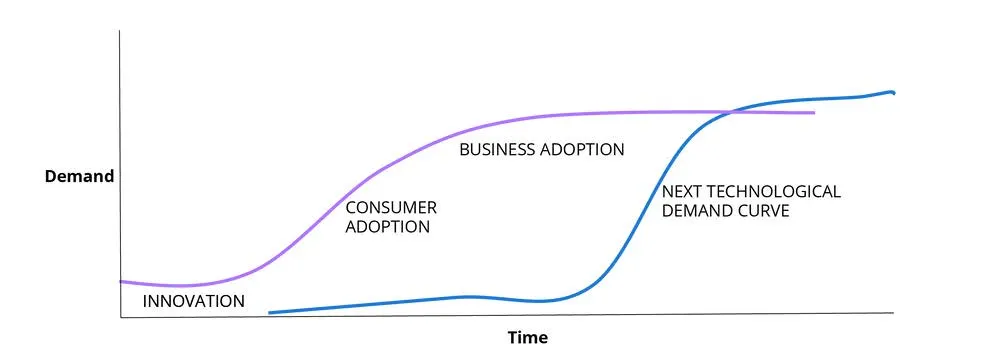

The cycle of technological adoption typically begins with consumer adoption. Once consumers become familiar with a technology, the technology diffuses into the business and industrial work environment.

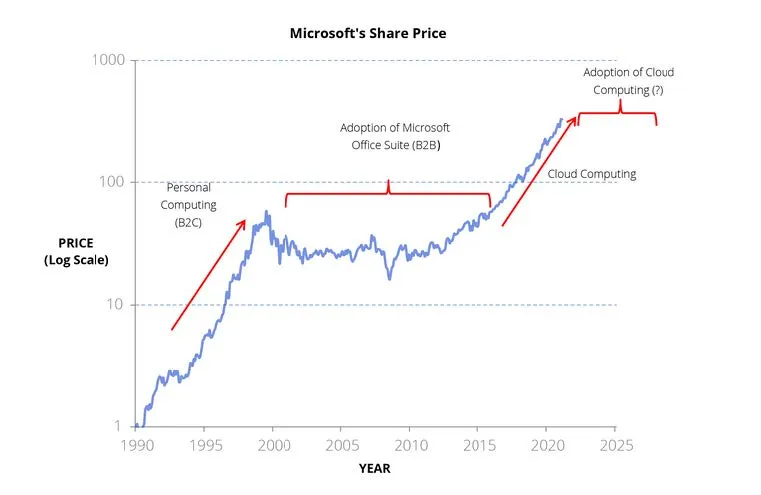

A useful analogy would be to observe the phases of development in Microsoft. As shown in the chart below, Microsoft’s share price grew strongly in the late 1990s as its personal computing (PC) products used mainly by consumers. This was its business-to-consumer (B2C) phase.

Figure 3: Microsoft’s Share Price

Source: Bloomberg, Lion Global Investors, December 2021

As businesses began to adopt Microsoft Office applications throughout the 2000s, we can see that Microsoft’s share price stagnated throughout the decade. Whilst Microsoft was still growing profitably, other businesses benefited more from deploying Microsoft Office to improve their productivity. Essentially, whilst Microsoft was creating value, the value was captured by the rest of the business and industrial community. This was its business-to business (B2B) phase.

Since 2016, Microsoft has benefited from cloud computing, AI and its associated technologies. As businesses begin to adopt this new technology, we could again envisage this transfer to value capture to business and industrial companies looking ahead. This is why we see a strong potential for companies in Singapore, many of whom specialize in business-to-business (B2B) and industrial applications, to benefit from this transfer of value capture.

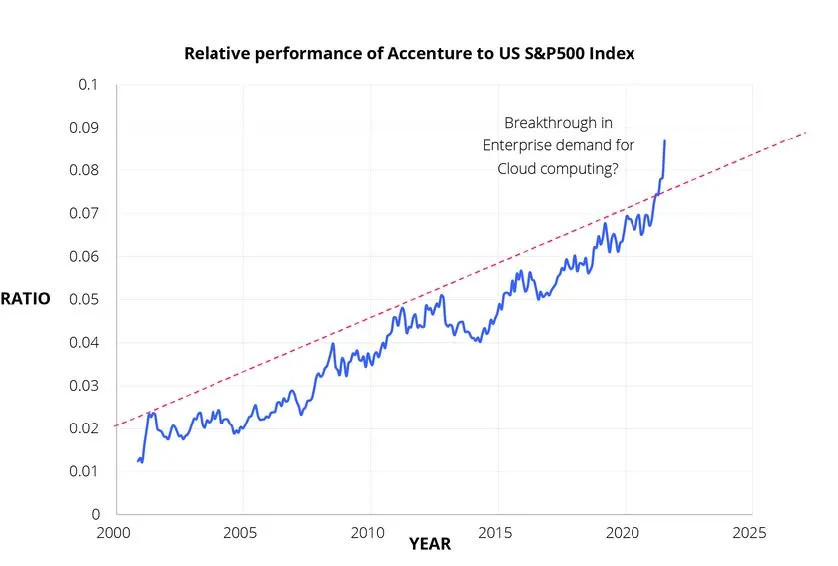

The Evidence is in Enterprise

In September 2021, the stock performance of Accenture PLC, a leading global technology systems integrator for business enterprises, did something it had not done for the past 20 years: it started to outperform beyond its typical trading range to the S&P 500 Index. This significant move was corroborated by Accenture’s outlook commentary that business enterprises are on the cusp of a multi-year journey to transform into cloud-enabled and data-enabled companies.

Figures 4: Relative performance of Accenture to US S&P500 Index

Source: Bloomberg, Lion Global Investors, December 2021

According to Accenture, this transition is marked by two waves: the first is the continued digital transition of business enterprises into the cloud, where a majority have still yet to do so. The second wave would be for companies already on the cloud to gain competitive advantages with their data through the use of AI and associated technologies1

1Source: Accenture 1Q22 Earnings Transcript, 16 December 2021

“Blue Cheaps”

During the pandemic, many blue-chip companies in Singapore had experienced significant declines in their share prices. We believe that the former blue chip companies have now become attractively “cheap”. Some have undergone a process of corporate restructuring to reposition for growth over the next decade, which marks a bottom for the fortunes of these companies. We believe that a combination of restructuring and cyclical recovery in these “Blue Cheaps” companies can be one of the key drivers of the Singapore market.

Figure 5: Selected “Blue Cheap” companies table

Source: Company websites

“Blue Cheaps” also stand to benefit from the aforementioned cycle of technological diffusion. For example, ST Engineering can employ data analytics, cloud managed solutions and satellite technology for smart city development opportunities2 .In the area of urban logistics, Singpost is currently trialing “smart letterboxes” that could transform the efficiency of parcel delivery and improve customer experience in a significant way3

2Source: ST Engineering 1H presentation slides, 10 November 2021

3Source: todayonline, 16 July 2021

Figure 6: Disruptive Innovations – Artificial Intelligence

Adopting artificial intelligence (AI) could also be a potential growth area for these “Blue Cheaps” companies. In August 2021, Temasek announced the acquisition of the AI startup, BasisAI, to create and scale AI solutions and develop a global centre of excellence in AI. BasisAI has deployed end-to-end machine learning solutions for organisations including ComfortDelGro, Singapore Airlines, and all three Singapore local banks4.

Some of these “Blue Cheaps” companies have global industrial or consumer data sets. The potential for these “Blue Cheaps” to apply AI to unlock their proprietary data could be transformational, and enable them to improve productivity and create new use-cases to drive value over the next decade.

4Source: Business Times, 31 August 2021