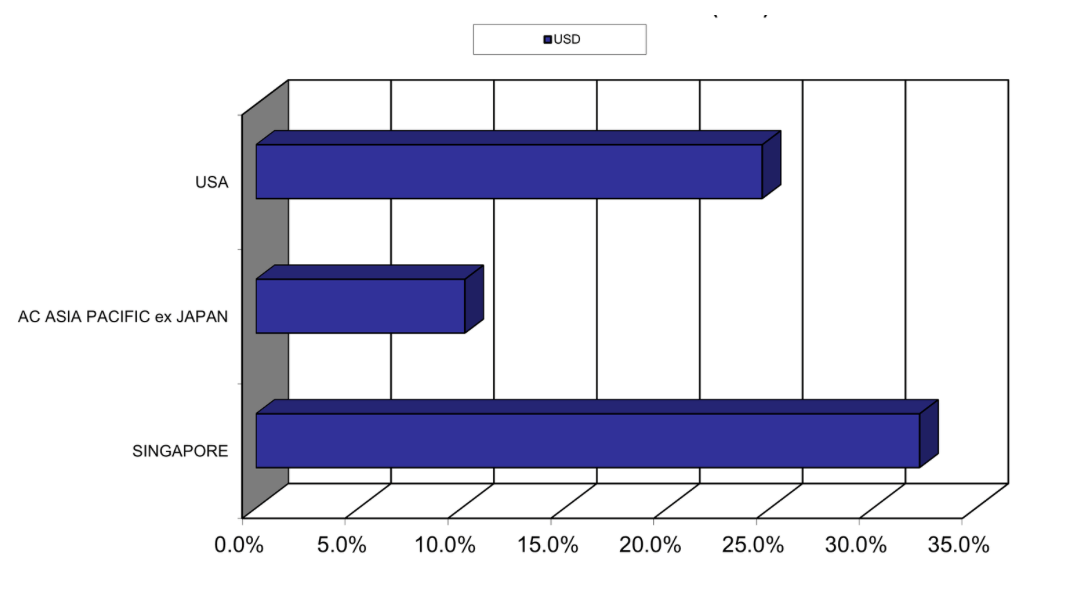

The Singapore Equity market has been a stellar performer in 2024, outperforming most markets in Asia and indeed keeping pace with the US markets. This is the first significant annual move in the Singapore market for more than 15 years, and we believe investors are positioning for further performance in the Singapore markets for the next 2-3 years.

Figure 1: MSCI Markets Net Total Return (YTD)

Source: Rimes, December 2024

Here are 3 megatrends that could drive the Singapore markets into global prominence over the next few years.

1. Geopolitical Uncertainty

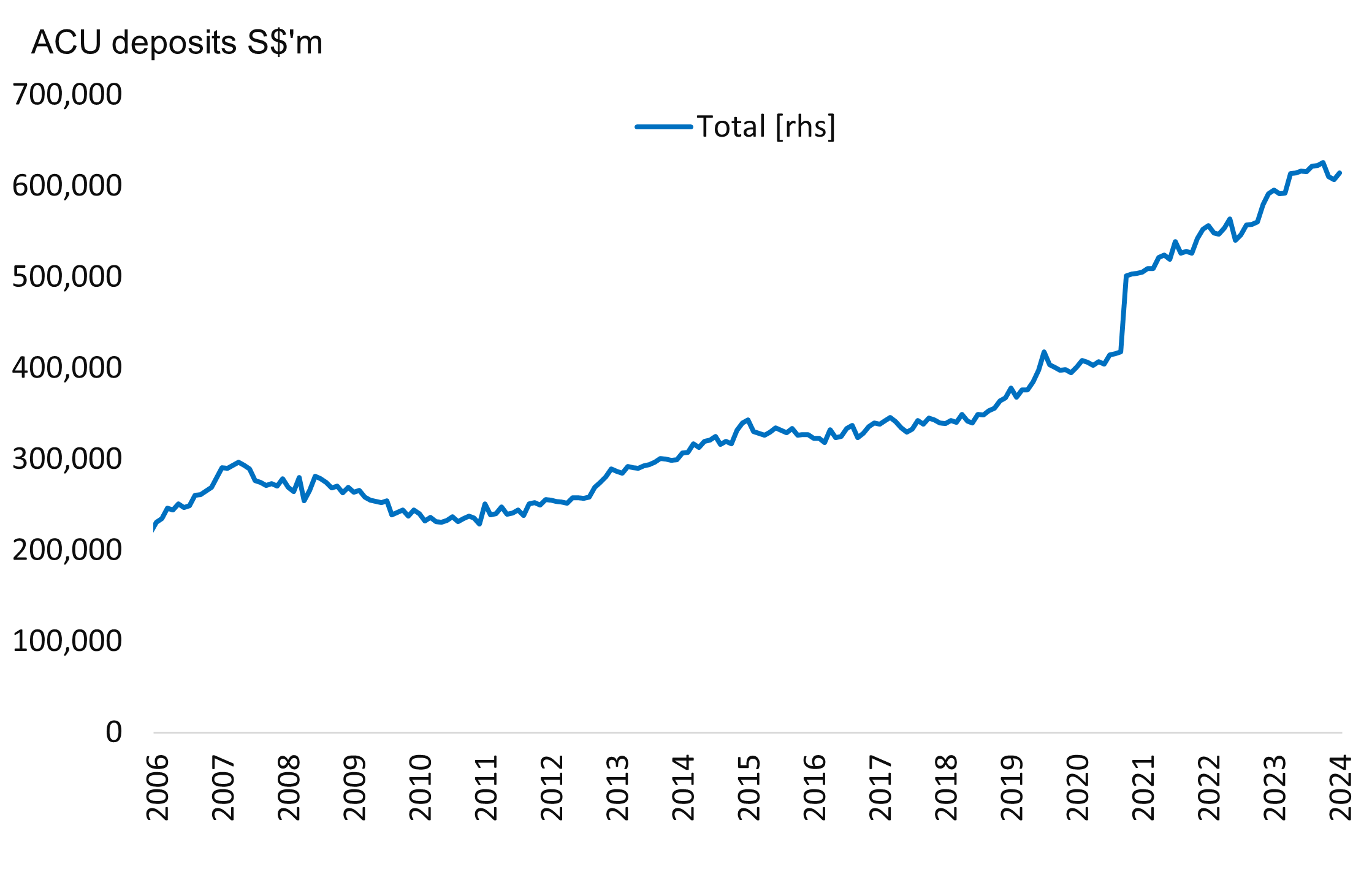

Singapore offers an oasis of safety amidst global geopolitical uncertainty. The Singapore banking system has been a major beneficiary of this global megatrend, continuing to attract foreign funds into the Singapore banking system. With uncertainty unlikely to abate under a Trump administration in America, we can expect Singapore banks to be a key beneficiary in the foreseeable future.

Figure 2: Deposits Increasing Over The Years

2. Industries Gaining Market Share:

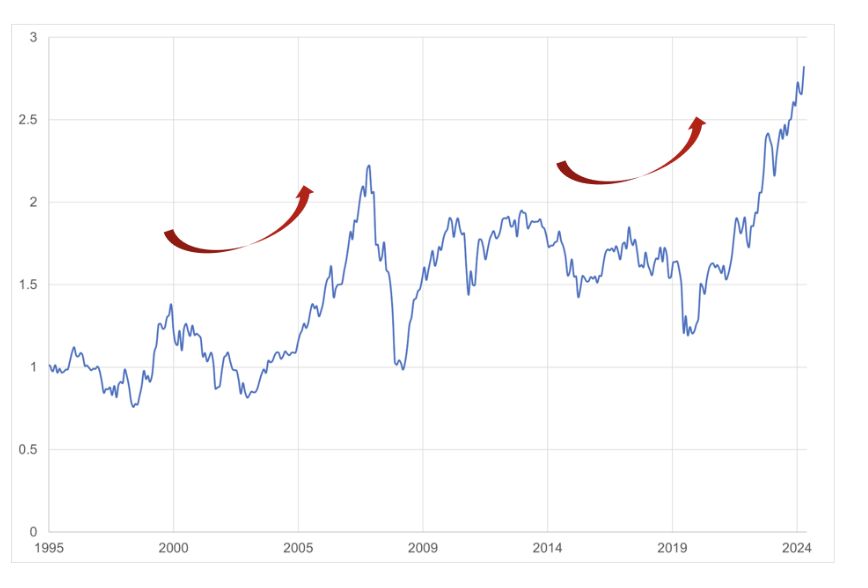

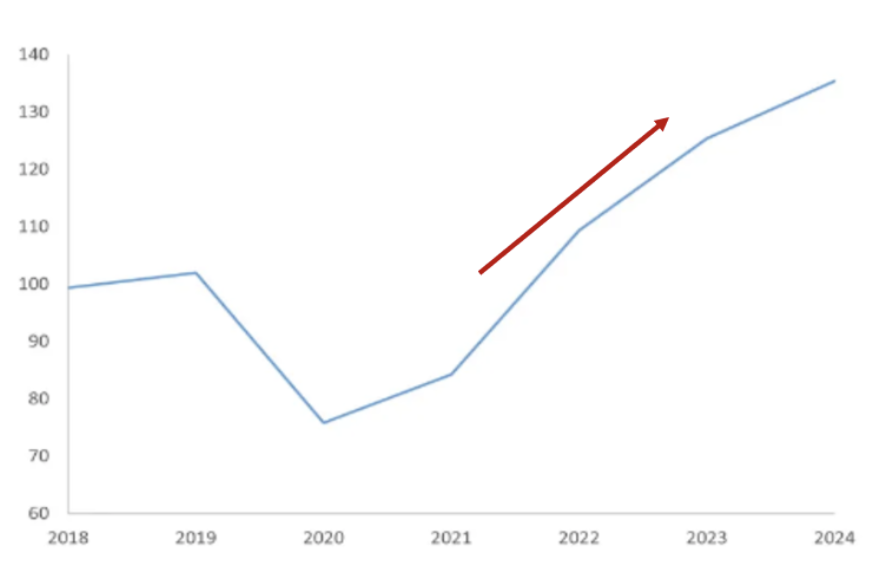

After more than a decade of industry consolidation, Singapore industrial firms are poised to benefit from a global capital expenditure cycle and gains in global market share. This reflects how global capital expenditure is likely to shift away from software over the past decade into hardware in this coming decade. This chart, which goes back 30 years, illustrates how Singapore Industrial firms go through a 10–15-year cycle. This coincides with the useful age of long-term infrastructure assets such as marine vessels, aircraft and power plants that undergo a replacement cycle after approaching 15 years. Therefore, having survived a period of industry consolidation, our offshore and marine, utilities, aviation and even e-commerce companies are now in the position to reap the rewards of market share gains over the next few years.

Figure 3: Index of Major Singapore Industrials

3. Macro reallocation away from bonds:

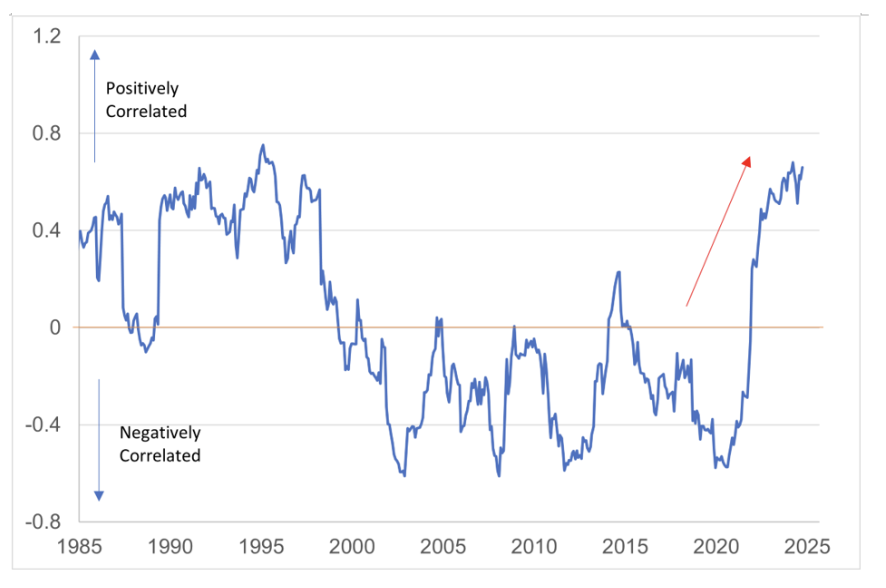

The higher for longer global inflation environment has diminished the attractiveness of bonds as a portfolio hedge against equities, as bonds have become more correlated in movements with equities. This is leading global asset managers to consider shifting allocations away from traditional bonds. Singapore equities are well positioned to attract funds seeking an inflation hedge due to its attractive and increasing dividend. Increasing dividends, not just flat dividends, are important because it offers investors the comfort that dividends can offset any further increases in inflation. Increasing dividends for Singapore Equities can be well supported by strong fundamentals in the banks and industrials sectors.

Figure 4: Correlation between US Stocks and Treasury Bonds

Source: Bloomberg, Lion Global Investors, December 2024

Figure 5: Weighted Index of Dividends Per Share of Singapore Index Constituents

4. The Big Picture.

Singapore equities are at a once-in-a-generation turning point. Looking at the relative performance of Singapore equities against global equities, we can see that Singapore equities have bounced off a major 20 year low not seen since the Asian Financial crisis, supported by the robust fundamentals of these 3 megatrends. We expect Singapore equities to continue to attract global interest for the sustainable future.

Figure 6: MSCI Singapore Index vs. MSCI World Index

Source: Bloomberg, December 2024

All data are sourced from Lion Global Investors and Bloomberg as at 31 December 2024 unless otherwise stated.