Surprise Policy Pivot Boosted China Markets in 2024

The Chinese economy has faced challenges the past few years as it emerged from Covid lockdowns, regulatory tightening and a protracted property downturn.

Yet, after three years of stock market declines that started in 2021, the markets posted a sharp rebound in 2024 with a 15% rise in the MSCI China Index. What triggered the sharp turnaround in markets was the policymakers pivoting towards a pro-growth stance at the end of September 2024. A broad range of policy directions have since been announced, including more proactive fiscal policy, further easing in monetary policy, restoring stability in the property

market and boosting consumption.

As investors awaited more details of the stimulus measures, China markets have given up some of the gains. The election of Donald Trump as US President also raised concerns of increased trade actions and tariffs against China, as he had threatened during his campaign.

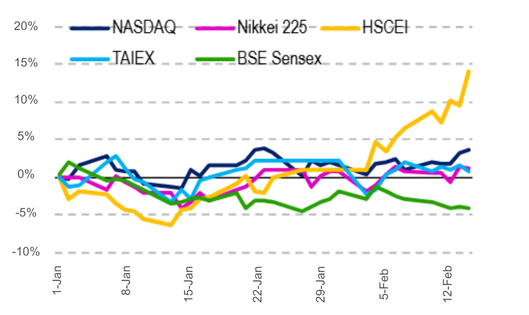

Figure 1: Year-To-Date Performance of Major Stock Market Indicies (USD Terms)

HSCEI rose nearly 15% YTD and outperformed global peers

Reasons for optimism in 2025

We acknowledge that challenges still persist for the Chinese economy, but hold the view that there are reasons to be optimistic in 2025.

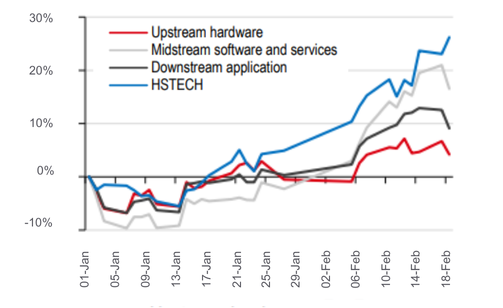

First, Chinese corporates have been moving up in technology and industrial innovation, making them a force to contend with in advanced manufacturing. From exporting lower value textile and footwear in the past, China has become the leading exporter of electric vehicles and solar panels. The recent breakthrough in artificial intelligence development with the Deepseek AI models is a reminder not to write off the resilience and drive of Chinese entrepreneurs. This has created excitement in the markets around the possibilities and benefits of increased AI use in various industries.

Figure 2: Artificial Value Chain in a A-share Market had a Slight Correction Recently, While Hang Seng Tech Remained Strong

Note: Data till 18 February 2025

Source: Wind, HSBC Qianhai Securitites

Second, Chinese consumption patterns have changed as incomes have been hit so there has been more downtrading, but there are segments of consumption that are doing well such as concept toys and beauty products. Consumers have also responded well to subsidies to trade-in autos and home appliances, and policymakers have expanded the categories of product eligible for trade-in. We see more emphasis by policymakers to boost consumption and there could be more support to provide a social safety net. Initiatives to resolve local government debt burdens will also put local governments in a better position to roll out their own consumption support measures.

Risks still persist

The risks to China markets are probably well known. Economic growth has been slowing and it may not be easy to achieve another year of 5% growth in 2025. Policymakers have been rather measured in rolling out stimulus, which makes it difficult to have a strong pick up in growth momentum.

Geopolitical risks also loom large, with the possibility of greater trade barriers put on Chinese exports, not only by the US but also by other economies whose industries are facing greater competition from Chinese exports.

Nonetheless, we see opportunities in the Chinese markets with a range of industries and companies that can do well despite the headwinds.

All data are sourced from Lion Global Investors and Bloomberg as at 17 February 2025 unless otherwise stated.