Global equities performed well this year with risk assets supported by healthy economic growth, decent earnings and a strong rally in the technology sector driven by the Artificial Intelligence trend. We see these positive conditions continuing into the new year and be supportive for risk assets. Some investors may see the potential policies by the new Trump administration as positive only for US equities, but we see investment opportunities for Asia equities too. Innovations driven the Artificial Intelligence would continue to create new investment opportunities in the new year. We are positive on Taiwan, Korea, India and Japan equities. Though credit spreads are tight on historical levels, the macro environment is positive for Asian credit bonds.

Macro Outlook

1. Market participants view a unified US government after a Trump victory in the US presidential election as being positive for the US economy. The key policy proposals include potential reduction in corporate tax rate, easing in regulations across various industries, and industrial policies to promote onshoring which could lead to increasing capital expenditures and economic growth in the US economy. However, there are also risks with the threat of more tariffs and deportation plans which could lead to higher inflation and a drag on future growth.

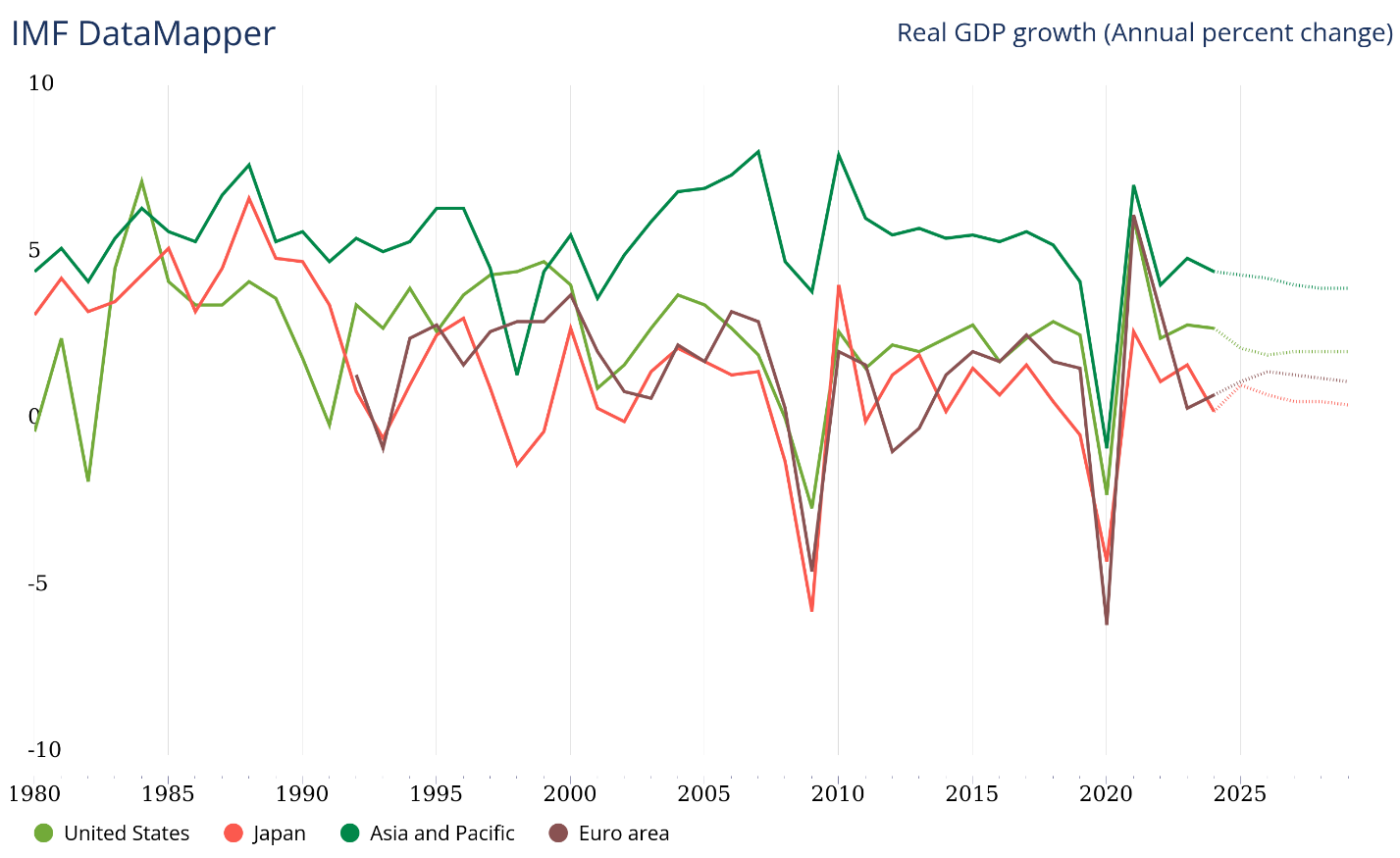

Figure 1: Interest rate cuts across major economies to boost weak real GDP growth

Source: International Monetary Fund dated December 2024

2. It is consensus view that the US economy continues to grow at a healthy pace in 2025 despite signs of weaknesses in the US labour market and muted manufacturing activities. The US Federal Reserve Chairman cited a stronger than expected economy in recent months as reason to consider a slower pace of interest-rate cuts ahead. That said, the continuing strength of the US economy would likely depend on the details and policies passed by the new US administration.

3. The Eurozone economy is in a difficult situation with weak economic growth when the two largest economies, Germany and France, are struggling with political gridlocks. And things could become more challenging with potential tariff threats from the US. That said, the new Trump administration could facilitate a potential end to the Ukraine and Russia conflict, which would lift economic activities across Europe. The European Central Bank (ECB) is on an easing cycle, having cut deposit rate again in October, and projected to continue cutting rates over the next few meetings on concerns of slowing economic growth and deflationary fears.

4. The Bank of Japan kept its policy settings unchanged in September instead of continuing on its interest rate hiking cycle. Wages are set to increase in the new year as the unions are looking to negotiate for another year of decent hike during the Shunto negotiations. All signs suggest that Japan has exited deflation, and that Japan is likely to meet its inflation target. Future interest rate hikes by the Bank of Japan would likely depend on the path of the Japanese Yen.

5. Economic growth is improving in China with stabilizing property sales, stronger consumption lifted by the consumer goods trade-in policy, and stronger exports potentially from front-loaded demand ahead of potential tariffs by the Trump administration. China could also announce stronger policy measures to shore up its economy and boost confidence to mitigate the threat of tariffs from the new Trump administration. Policymakers in China have raised expectations with comments that they would adopt a “moderately loose” monetary stance and more “proactive” fiscal policies in the new year. All eyes are now on the details of new policies that would be announced by various government agencies.

Equity

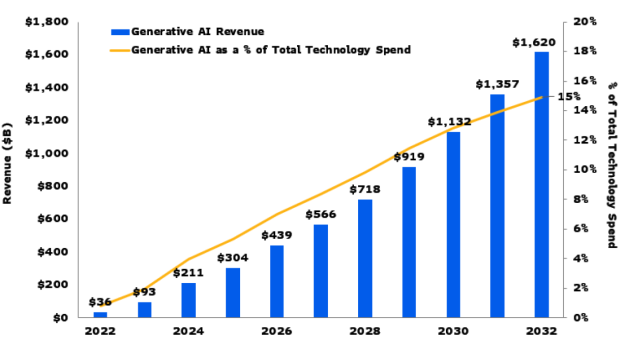

6. We see healthy economic growth supported by conducive monetary policies as positive for risk assets in 2025 though policy uncertainties from the incoming Trump administration remains. We continue to view the Artificial Intelligence trend as positive for markets exposed to the technology sector.

7. We are positive on US equities despite high valuations. Earnings growth expectations for US equities could see upward revisions from further deregulation and lower taxes next year. We are more sanguine on European equities. A lack of effective political leadership in Germany and France in the face of potential tariffs from the US means European equities could be value traps despite attractive valuations.

8. We see pockets of opportunities for Asia equities. We are positive on Taiwan equities, though we could see heightened volatility as Taiwan is caught in the crosshair of the US and China rivalry. Artificial Intelligence (AI) is a long-term positive investment theme for Taiwan equities and the AI-related supply chain in Taiwan would likely be relatively unimpacted, while consumer electronics are more vulnerable. It is unclear if the Taiwan notebook and Apple related supply chains would be exempted from tariffs. Temporary periods of heightened political risks could lead to an increase in equity risk premium and temporary weakness in share prices.

Figure 2: Multi-year growth in Generative Artificial Intelligence spending is tailwind to technology heavy markets

Source: Bloomberg Intelligence’s forecast based on data from IDC, eMarketer, Statista, dated November 2024

9. We see Korea equities as oversold due to weak sentiments from the unfolding Korean political unrest on top of a tariff scare. Past impeachment cases in 2004 and 2017 suggest that the current political turmoil could present an attractive investment opportunity as the deep discounts in Korean equities would reverse when political stability returns. The performance of Korea equities market has historically been driven by external market factors and less so from domestic factors.

10. We have turned more positive on India equities after healthy corrections in recent months. Sentiments are not too optimistic, and Initial Public Offerings are no longer viewed as sure-win bets. The India stock market has become more sensitive to valuations, which is healthy. India remains a well-understood positive structural story that justifies a premium to valuations. Temporary factors such as heatwaves, election delays, a lack of government spending, and more structural factors such as increasing competition could create opportunities for stock-picking in the India equities market.

11. The Japan equities market is subjected to the same policy risks from the incoming US administration, and it remains to be seen if the current political leaders could strike a similar rapport with the incoming Trump administration. However, Japan equities would still be supported by structural growth themes such as factory automation, digitalization and the continuing inbound consumption trend. Corporate restructuring driving better shareholders’ returns is also a positive domestic catalyst for the Japan equities market.

12. We see greater volatility for ASEAN equities which may be affected by potential tariffs on trade and a stronger US dollars resulting in currency outflow from the region. The Singapore equities market is trading at a discount to its long-term historical average and its dividend yield is attractive compared to other developed markets. Other ASEAN markets could also benefit from trade diversions and capital flows, given ASEAN's neutral stance to the US and China rivalry. In addition, ASEAN's growth is largely driven by domestic consumption, investments and government spending, which we expect would continue over the next few years. We are positive on companies that are beneficiaries of domestic growth driven by fiscal spending, consumption and Foreign Direct Investments.

Fixed Income

13. A moderate macro environment which is constructive for risk assets is also positive for Asian credit bonds. Asian credit bonds are leveraged to potential bond price rallies if US interest rates move lower. As highlighted earlier, recent US economic data could mean continuing interest rate cuts in the US, albeit potentially at a slower pace. And the trend is also for major central banks to cut rates which would be supportive for Asian credit bond prices. The risk for longer dated bonds would be the unlikely event of a significant resurgence in inflationary pressure causing the Fed to pause or to hike rates again.

14. The credit spread component of credit bonds are trading near historical tight levels and considered in unattractive zone. A decompression of credit spreads in reaction to a fall in interest rates is probable. Nonetheless, bond markets are currently driven more by the focus on all-in bond yield which is considered attractive by historical standards. In the expected soft-landing scenarios, we expect company fundamentals and credit trends to remain supported. Near term, credit spreads are expected to move sideways to modestly wider, within a small range on support from supply technicals. Low new bond issuances in Asia to replace bond maturities should be technically supportive for tight credit spreads. Issuance by China issuers, which used to account for two-thirds of annual gross supply, has dropped significantly given cheaper onshore funding. The direct impact on China credit bonds from any potential trade tariff hikes is likely to be limited.

All data are sourced from Lion Global Investors and Bloomberg as at 17 December 2024 unless otherwise stated.