Steadier, Stronger Singapore

The ongoing war in Ukraine. Escalating conflict in the Middle East. Electoral uncertainty in the United States amidst rising unemployment. The global macroeconomy is fraught with uneasiness, complexity and conflict.

Recent market movements also suggest a cautionary outlook in the near term. On 5th August 2024, the Japanese stock Index TOPIX plunged by 12%, its worst performance since 1987, sparking sharp moves across global equities, including a 4% decline in the MSCI Singapore Index. The cause of this- a weaker US consumer price index print in July exacerbated by an unwinding of leveraged trades based on the yen currency – could continue to have ramifications over global financial stability as we head into the seasonally volatile month of September for global equity markets.

Yet from a broader global equity market perspective, Singapore’s fundamentals remain steady and could act as a safe haven amidst volatility. Indeed, growing dividends that reflect the unique attributes of the Financial and Industrial sectors make the Singapore equity market stronger amidst the global uncertainty.

In earlier publications, we have highlighted how the financial and industrial sectors would be key pillars of growth of the Singapore equity market throughout this decade. Since then, we have seen progress in these two sectors towards delivering strong results.

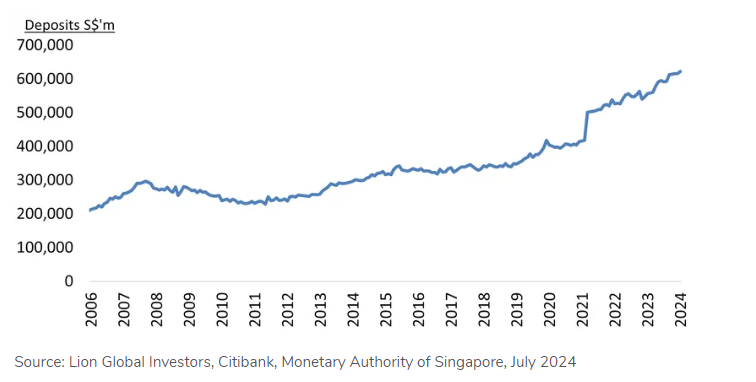

As the politics of de-globalisation and protectionism continue to set the tone for this decade, the Singapore banking system positioning as a global safe haven grows from strength to strength. Of note, foreign deposits flow into Singapore remains unabated, especially post-pandemic (see Figure 1). This data reinforces Singapore’s strength as the pre-eminent British rule of law-based financial hub in the Asian region with a triple-A sovereign rating, enabling it to continue to attract financial flows seeking stability.

Figure 1: Cumulative Deposits in Singapore banking system

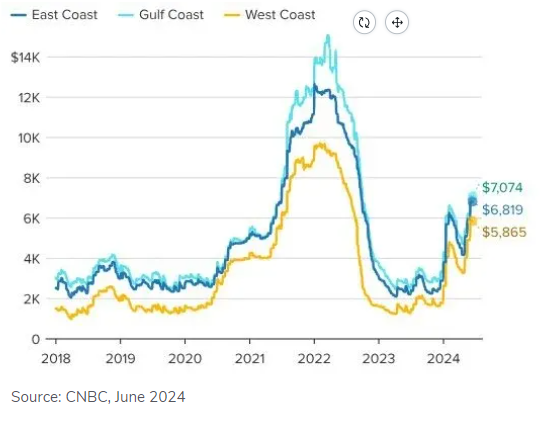

In the Industrial sector, Singapore companies are well positioned to take advantage of tightening supply chains that result from de-globalisation and geopolitical uncertainty. For instance, rising shipping freight rates caused by Middle East this year have spilled over into higher air cargo rates. Both the marine engineering and aerospace-related Industrial firms in Singapore can benefit from higher demand due to higher sea and air freight rates stemming from persistent geopolitical uncertainty and lengthening of supply chains.

Figure 2: Snippet from CNA Article

Figure 3: Shipping rates from East Asia to U.S. ports (2024). Daily Average for 40-foot equivalent units

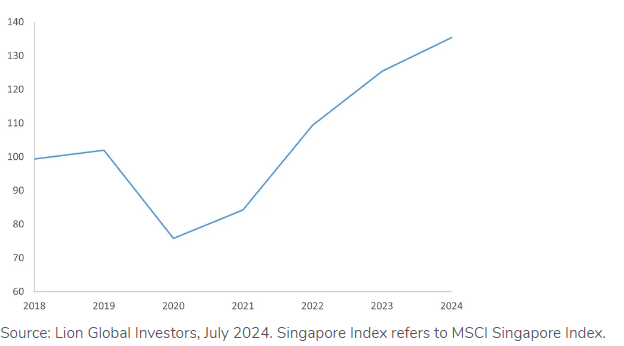

The strong performance of the Financial and Industrial sectors have also strengthened their ability to increase dividends. Whilst dividends in 2020 understandably declined due to the COVID pandemic, constituent companies in the MSCI Singapore Index have increased dividends per share to levels higher than pre-pandemic levels on a weighted basis (See Figure 4 below).

Figure 4: Weighted Index of Dividends Per Share of Singapore Index Constituents

We believe this increase in the dividend-paying ability of Singapore listed companies is globally significant, both in the nearer and longer term. In the shorter term, a global rate easing cycle would make a dividend paying market like Singapore more attractive to global funds. Growing dividends would also make the Singapore equity market in the longer term, as global asset allocators may consider shifting bond allocations towards dividend paying equities as an inflation hedge. This is because the process of de-globalisation is inflationary in nature, as tariffs impose trade friction whilst supply chains lengthen and inventory levels rise to mitigate the risk of disruptions.

Therefore, Singapore equities are well-positioned to attract global funds looking for dividends and as an longer term inflation hedge as an alternative to traditional bonds.

LIONGLOBAL SINGAPORE DIVIDEND EQUITY FUND

The LionGlobal Singapore Dividend Equity Fund aims to provide investors with regular distributions and long-term capital growth by investing primarily in high and/or sustainable dividend yielding equities (including real estate investment trusts, business trust and exchange traded funds) listed on the Singapore Stock Exchange (Mainboard and Catalist) or listed outside of Singapore.

Despite the recent volatility in the markets, Singapore remains a steadfast safe haven for investors. In the longer term, Singapore's strategic positioning as a global financial hub and its ability to benefit from global supply chain tightening can boost confidence in its economic prospects. In the near term, the concerns over recession would weigh on global equity market performance, which could present an attractive entry point for the Singapore market.

All data are sourced from Lion Global Investors and Bloomberg as at 5 August 2024 unless otherwise stated.