Disclaimer - Lion Global Investors Limited

The IntraDay Indicative NAV (iNAV) shown is provided by S&P Global Limited (“S&P”). The iNAV is indicative and for reference purposes only. It may differ from the actual NAV calculated in accordance with the Trust Deed and should not be viewed as the actual NAV. Please refer to the actual NAV on our website.

The iNAV is the best estimate of the intraday fair value per Unit calculated throughout the SGX‑ST trading hours and is based on the latest mid-price of the underlying securities when the market for the underlying securities is open, or fair value adjusted prices or replacement instrument price when the market of the underlying securities is closed. The fair value adjustment is based on regression models estimating the correlation between value of the underlying securities and proxy instruments such as index futures with real-time prices during the SGX‑ST trading hours. If for the value of an underlying security, no proxy instrument has significant explanatory power, the last market close price of the security will be used. The value of the underlying securities are converted into SGD and USD using near real-time foreign exchange rates. The iNAV is not, and should not be taken or relied on as being, the Net Asset Value per Unit or the price at which the Units may be subscribed for or redeemed through a Participating Dealer or purchased or sold on the SGX‑ST.

Neither S&P, its affiliates nor any of its third party data providers makes any representation or warranty, express or implied, as to the accuracy, completeness or timeliness of the data contained herein nor as to the results to be obtained by recipients. S&P is not responsible for and has not participated in the determination of the prices and amount of the Fund or the timing of the issuance or sale of the Units of the Fund or in the determination or calculation of the equation by which Units of the Fund are converted into cash. S&P has no obligation or liability in connection with the administration, marketing or trading of the Fund. Furthermore, S&P has no obligation to update, modify or amend this data or to otherwise notify a recipient if any data changes or subsequently becomes inaccurate. THE INAV IS NOT, AND SHOULD NOT BE TAKEN OR RELIED ON AS BEING, THE NET ASSET VALUE PER UNIT OR THE PRICE AT WHICH UNITS MAY BE SUBSCRIBED FOR OR REDEEMED THROUGH A PARTICIPATING DEALER OR PURCHASED OR SOLD ON THE SGX-ST. NO ASSURANCE CAN BE GIVEN THAT THE INAV WILL BE UP TO DATE AT ALL TIMES OR FREE FROM ERROR. WITHOUT LIMITING THE FOREGOING, NEITHER S&P, ITS AFFILIATES NOR ANY THIRD PARTY DATA PROVIDER SHALL HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), WHATSOEVER TO YOU, WHETHER IN CONTRACT (INCLUDING UNDER AN INDEMNITY), IN TORT (INCLUDING NEGLIGENCE), UNDER A WARRANTY, UNDER STATUTE OR OTHERWISE, EVEN IF NOTIFIED OF THE POSSIBILITY OF THE SUCH DAMAGES IN RESPECT OF ANY INACCURACIES, ERRORS OR OMISSIONS, OR ANY LOSS OR DAMAGE SUFFERED BY YOU AS A RESULT OF OR IN CONNECTION WITH THE S&P DATA CONTAINED HEREIN. ALL INTELLECTUAL PROPERTY AND OTHER PROPRIETARY RIGHTS COMPRISED IN THE S&P DATA ARE AND SHALL BE THE EXCLUSIVE PROPERTY OF S&P.

The Indicative NAV per unit in USD and JPY is for reference only and is calculated using the actual NAV per unit in SGD converted into USD and JPY, using the exchange rates quoted by Reuters at 4:00 p.m. (Hong Kong time) as of the same Dealing Day.

The Lion-Nomura Japan Active ETF (Powered by AI) is Singapore's first actively managed ETF and Singapore's first AI-powered ETF. With the expertise of Lion Global Investors and Nomura Asset Management, our proprietary AI models evaluate hundreds of factors to uncover hidden gems with strong growth potential.

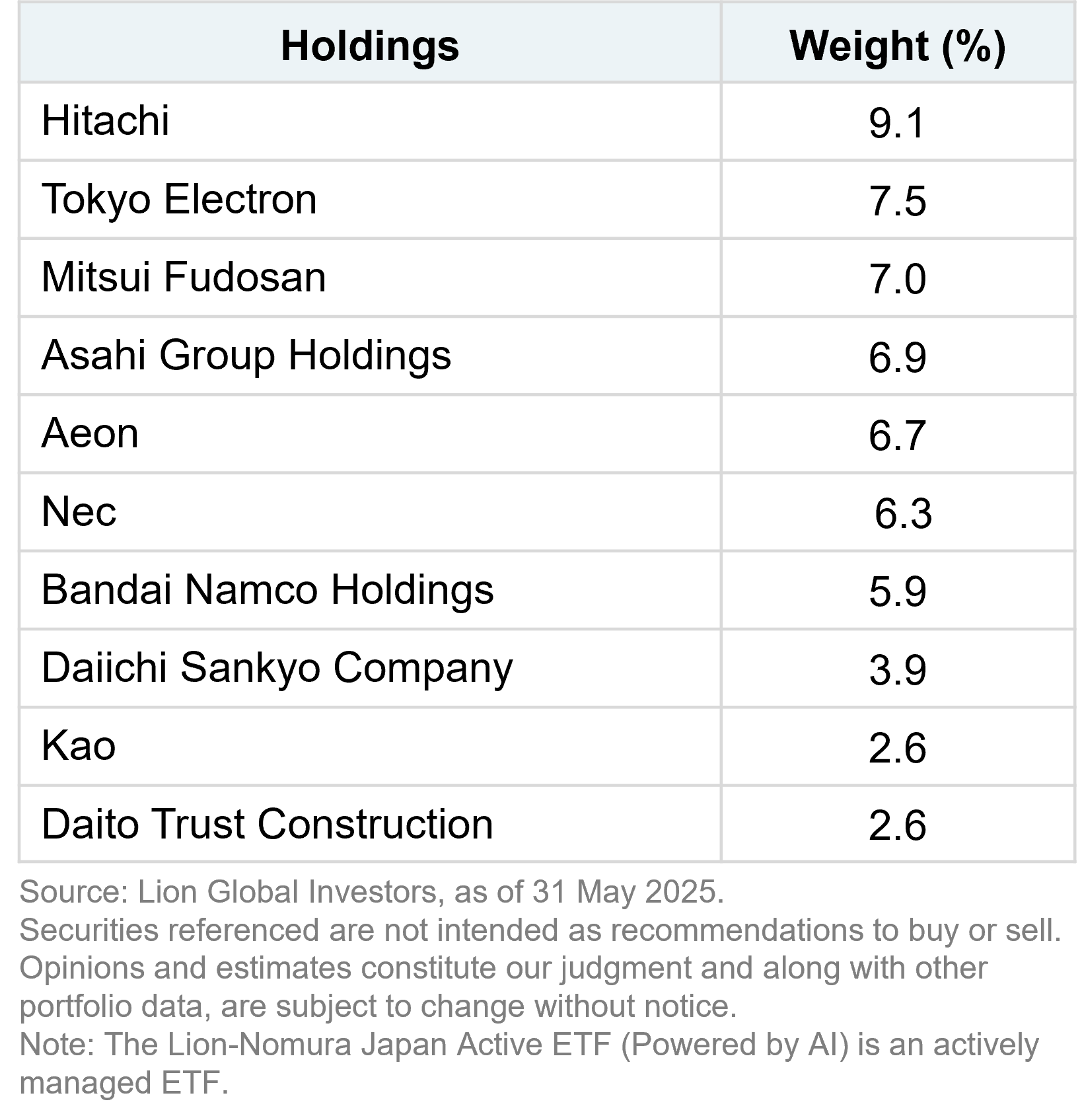

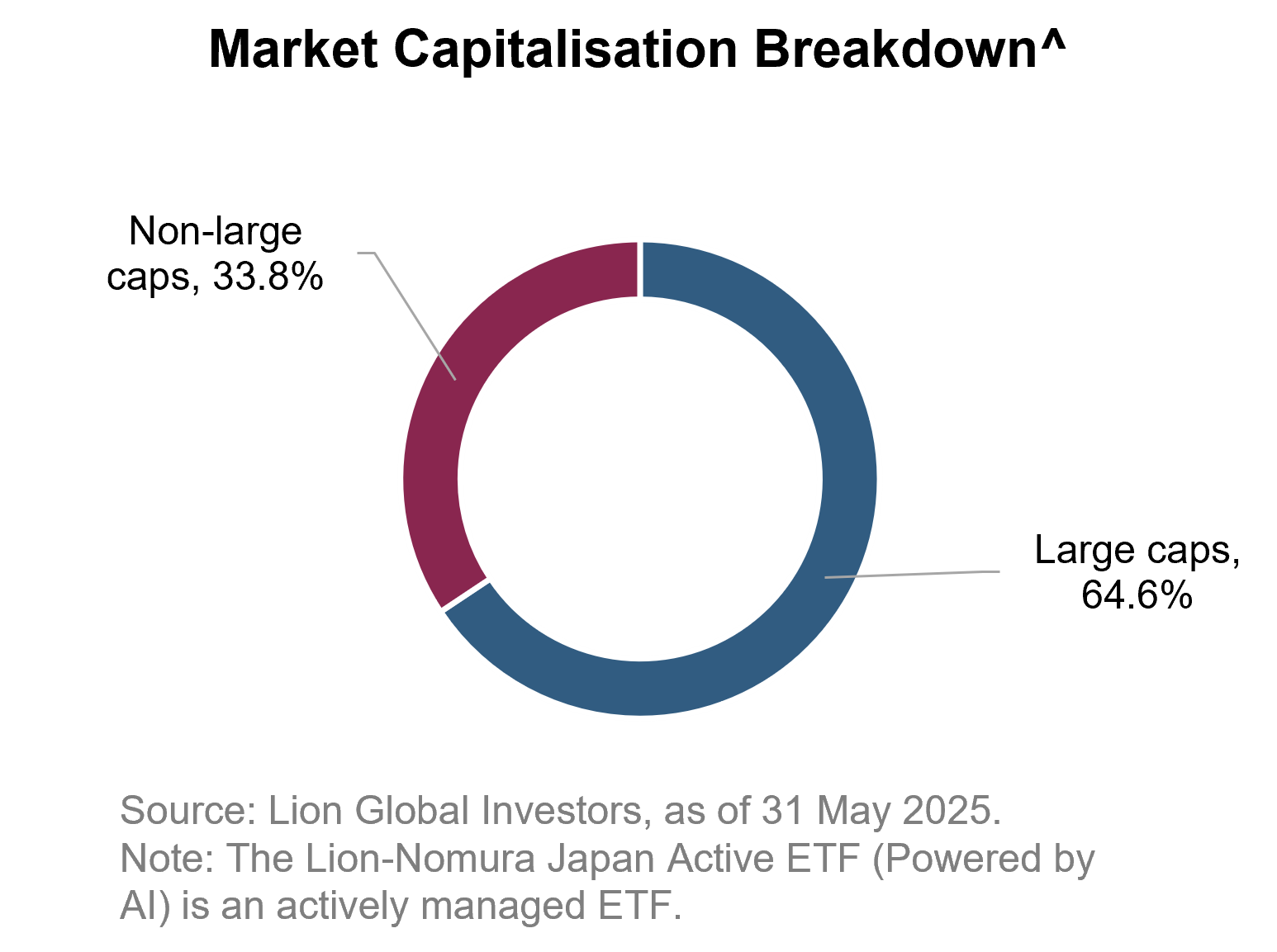

The investment objective of the Fund is to achieve long-term capital growth through investment in an actively managed portfolio of Japanese equity securities, diversified across sectors and market capitalisation.

The above chart is based on historical NAVs of the Fund. Past performance is not necessarily indicative of future performance.

Source: Lion Global Investors

| Reference Benchmark | Tokyo Stock Price Index (TOPIX) |

| Investment Advisor | Nomura Asset Management Co Ltd |

| Listing Date | 31 January 2024 |

| Issue Price | SGD 1.00 |

| Base Currency | JPY |

| Trading Currency | SGD, USD |

| SGX Code | JJJ (SGD), JUS (USD) |

| Bloomberg Ticker | JAISGD SP (SGD), JAIUSD SP (USD) |

| ISIN | SGXC22115700 |

| Trading Board Lot Size | 1 unit |

| Management Fee |

Currently 0.70% p.a of the Net Asset Value of the Fund. Maximum 0.99% p.a of the Net Asset Value of the Fund. The Manager’s fee is retained by the Manager as the Manager does not pay any trailer fees with respect to the Fund. |

| Classification Status | Excluded Investment Product |

| Designated Market Maker | Flow Traders Asia Pte Ltd, Phillip Securities Pte Ltd |

The Fund is only suitable for investors who:

- seek to achieve long-term capital growth through investment in an actively managed portfolio of Japanese equity securities; and'

- are comfortable with the volatility and risks of an equity fund.

Gain easy access to Japan’s awakening

- Japan has awakened from its slumber, with the Tokyo Stock Price Index (TOPIX) reaching a 33-year high in 2023. Japan’s long-term growth story is now favorably shaped by structural catalysts like corporate governance reforms and inflation. As these catalysts take time to be priced in, Japan is still at an attractive entry point now.

Use the power of AI and active management to select quality Japanese stocks

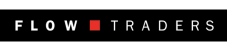

- Our proprietary AI models evaluates hundreds of factors to assign scores to each stock in the investable universe. The investment team (consisting of both Lion Global Investors and Nomura Asset Management) then select and assign weights to the stocks based on their AI model scores. The result is a final portfolio of 50 to 100 quality Japanese stocks.

Tap on the deep expertise of Lion Global Investors and Nomura Asset Management

- We combine our strengths to bring you the Lion-Nomura Japan Active ETF, which is both Singapore’s first actively managed ETF and Singapore’s first AI-powered ETF.

Some advantages of an AI-powered ETF include:

1. Capacity

Our proprietary AI models are faster than humans and can evaluate hundreds of factors in securities selection.

2. Disciplined

Our proprietary AI models avoid bias and emotions in the investment decision making process.

3. Rigorous

Our proprietary AI models undergo a robust and scientific development process with oversight and inputs from experienced fund managers. The models are typically refreshed monthly and respond to trends dynamically.

These 3 key advantages enable this fund to identify quality Japanese stocks efficiently and invest effectively.

Passive ETFs track a benchmark index and are constrained by the index rules and methodology. Active ETFs do not track a benchmark index and are less constrained, potentially giving it more room to outperform the broader market.

The Lion-Nomura Japan Active ETF (Powered by AI) is actively managed using proprietary investment strategies and processes. The Fund is subject to active management or security-selection risk and its performance, will reflect, in part, our ability to select investments and to make investment decisions that are suited to achieving the Fund’s investment objective.

As the Fund expense ratio is dependent on the fund size, the expense ratio is currently not yet available. The expense ratio will be published in the Fund’s semi-annual report. The annual management fee is 0.70% per annum currently.

This collaboration came about because of our shared vision to be innovative and desire to meet the evolving needs of our clients. It was a natural collaboration as we both had complementing AI capabilities and wanted to bring an actively managed, cost-efficient solution to the Singapore market.

Webinar & Physical Event

*References to specific corporations/companies and their trademarks are not intended as recommendations to purchase or sell investments in such corporations/companies nor do they directly or indirectly express or imply any sponsorship, affiliation, certification, association, approval, connection or endorsement between any of these corporations/companies and Lion Global Investors Limited or the products and services of Lion Global Investors Limited.

Disclaimer – Lion Global Investors Limited

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. It is for information only, and is not a recommendation, offer or solicitation to deal in any capital markets products or investments and does not have regard to your specific investment objectives, financial situation, tax position or particular needs.

You should read the Prospectus and Product Highlights Sheet for the Lion-Nomura Japan Active ETF (Powered by AI) (“ETF”) which are available and may be obtained from Lion Global Investors Limited (“LGI”) or any of the appointed Participating Dealers (“PDs”), for further details including the risk factors and consider if the ETF is suitable for you and seek such advice from a financial adviser if necessary, before deciding whether to purchase units in the ETF. Investments in the ETF are not obligations of, deposits in, guaranteed or insured by LGI or any of its affiliates and are subject to investment risks including the possible loss of the principal amount invested. The ETF is an actively managed exchange traded fund. Please refer to the Prospectus for further details, including a discussion of certain factors to be considered in connection with an investment in an actively managed exchange traded fund.

The performance of the ETF, the value of its units and any accruing income are not guaranteed and may rise or fall. Past performance, payout yields and payments and any predictions, projections, or forecasts are not indicative of the future or likely performance, payout yields and payments of the ETF. Any extraordinary performance may be due to exceptional circumstances which may not be sustainable. Any dividend distributions, which may be either out of income and/or capital, are not guaranteed and subject to the manager of the ETF’s discretion. Any such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value of the ETF. Any references to specific companies or securities are for illustration purposes and are not to be considered as recommendations to buy, sell or otherwise invest in such securities or the products or services of such companies. It should not be assumed that investment in such specific securities will be profitable. There can be no assurance that any of the allocations or holdings presented will remain in the ETF at the time this information is presented.

You should independently assess and conduct your own investigation of the relevance, accuracy, adequacy and reliability of any information, opinion or estimates, graphs, charts, formulae or devices provided and seek professional advice on them. Any information, opinions, estimates, graphs, charts, formulae or devices provided are subject to change or correction without notice and are not to be relied on as advice. The information and opinions contained in this advertisement or publication have been derived from or reached from proprietary or non-proprietary sources believed in good faith to be reliable but have not been independently verified. LGI makes no guarantee, representation or warranty, express or implied, and accepts no responsibility for the accuracy or completeness of this advertisement or publication. No warranty is given and no liability is accepted for any loss arising directly or indirectly as a result of you acting on such information.

Where pro-forma portfolio diagrams and/or charts and constituent weightage are displayed in this advertisement or publication (if any), such pro-forma diagrams and/or charts and constituent weightage are illustrative only and do not represent the actual holdings of the ETF at any point in time and are subject to changes at LGI’s discretion. You should refer to the portfolio holdings to be displayed on LGI’s website every month for more information on the actual holdings of the ETF (as at the date specified) in the previous month or should approach LGI for more information on the ETF. The sectoral representation in the pro-forma portfolio diagrams and/or charts (if any) also do not reflect the actual or future performance of the ETF.

The ETF may, where permitted by the Prospectus, invest in financial derivative instruments for hedging or for the purposes of efficient portfolio management. The ETF’s net asset value may have higher volatility as a result of its narrower investment focus on a single market (namely, Japan), when compared to funds investing in global or wider regional markets. LGI, its related companies, their directors and/or employees may hold units of the ETF and be engaged in purchasing or selling units of the ETF for themselves or their clients.

The units of the ETF are listed and traded on the Singapore Exchange Securities Trading Limited (“SGX-ST”), and may be traded at prices different from its net asset value, suspended from trading, or delisted. Such listing does not guarantee a liquid market for the units. You cannot purchase or redeem units in the ETF directly with the manager of the ETF, but you may, subject to specific conditions, do so on the SGX-ST or through the PDs.

© Lion Global Investors® Limited (UEN/ Registration No. 198601745D). All rights reserved. LGI is a Singapore incorporated company and is not related to any corporation or trading entity that is domiciled in Europe or the United States (other than entities owned by its holding companies)

Disclaimer – JPX Market Innovation & Research, Inc.

The TOPIX Index Value and the TOPIX Marks are subject to the proprietary rights owned by JPX Market Innovation & Research, Inc. or affiliates of JPX Market Innovation & Research, Inc. (hereinafter collectively referred to as “JPX”) and JPX owns all rights and know-how relating to TOPIX such as calculation, publication and use of the TOPIX Index Value and relating to the TOPIX Marks. JPX shall not be liable for the miscalculation, incorrect publication, delayed or interrupted publication of the TOPIX Index Value.

Disclaimer - S&P

Neither S&P, its affiliates nor any of its third party data providers makes any representation or warranty, express or implied, as to the accuracy, completeness or timeliness of the data contained herein nor as to the results to be obtained by recipients. S&P is not responsible for and has not participated in the determination of the prices and amount of the Fund or the timing of the issuance or sale of the Units of the Fund or in the determination or calculation of the equation by which Units of the Fund are converted into cash. S&P has no obligation or liability in connection with the administration, marketing or trading of the Fund. Furthermore, S&P has no obligation to update, modify or amend this data or to otherwise notify a recipient if any data changes or subsequently becomes inaccurate. THE INAV IS NOT, AND SHOULD NOT BE TAKEN OR RELIED ON AS BEING, THE NET ASSET VALUE PER UNIT OR THE PRICE AT WHICH UNITS MAY BE SUBSCRIBED FOR OR REDEEMED THROUGH A PARTICIPATING DEALER OR PURCHASED OR SOLD ON THE SGX-ST. NO ASSURANCE CAN BE GIVEN THAT THE INAV WILL BE UP TO DATE AT ALL TIMES OR FREE FROM ERROR. WITHOUT LIMITING THE FOREGOING, NEITHER S&P, ITS AFFILIATES NOR ANY THIRD PARTY DATA PROVIDER SHALL HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), WHATSOEVER TO YOU, WHETHER IN CONTRACT (INCLUDING UNDER AN INDEMNITY), IN TORT (INCLUDING NEGLIGENCE), UNDER A WARRANTY, UNDER STATUTE OR OTHERWISE, EVEN IF NOTIFIED OF THE POSSIBILITY OF THE SUCH DAMAGES IN RESPECT OF ANY INACCURACIES, ERRORS OR OMISSIONS, OR ANY LOSS OR DAMAGE SUFFERED BY YOU AS A RESULT OF OR IN CONNECTION WITH THE S&P DATA CONTAINED HEREIN. ALL INTELLECTUAL PROPERTY AND OTHER PROPRIETARY RIGHTS COMPRISED IN THE S&P DATA ARE AND SHALL BE THE EXCLUSIVE PROPERTY OF S&P.

.png)