Disclaimer - Lion Global Investors Limited

The IntraDay Indicative NAV (iNAV) shown is provided by S&P Global Limited (“S&P”). The iNAV is indicative and for reference purposes only. It may differ from the actual NAV calculated in accordance with the Trust Deed and should not be viewed as the actual NAV. Please refer to the actual NAV on our website.

Neither S&P, its affiliates nor any of its third party data providers makes any representation or warranty, express or implied, as to the accuracy, completeness or timeliness of the data contained herein nor as to the results to be obtained by recipients. S&P is not responsible for and has not participated in the determination of the prices and amount of the Fund or the timing of the issuance or sale of the Units of the Fund or in the determination or calculation of the equation by which Units of the Fund are converted into cash. S&P has no obligation or liability in connection with the administration, marketing or trading of the Fund. Furthermore, S&P has no obligation to update, modify or amend this data or to otherwise notify a recipient if any data changes or subsequently becomes inaccurate. THE INAV IS NOT, AND SHOULD NOT BE TAKEN OR RELIED ON AS BEING, THE NET ASSET VALUE PER UNIT OR THE PRICE AT WHICH UNITS MAY BE SUBSCRIBED FOR OR REDEEMED THROUGH A PARTICIPATING DEALER OR PURCHASED OR SOLD ON THE SGX-ST. NO ASSURANCE CAN BE GIVEN THAT THE INAV WILL BE UP TO DATE AT ALL TIMES OR FREE FROM ERROR. WITHOUT LIMITING THE FOREGOING, NEITHER S&P, ITS AFFILIATES NOR ANY THIRD PARTY DATA PROVIDER SHALL HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), WHATSOEVER TO YOU, WHETHER IN CONTRACT (INCLUDING UNDER AN INDEMNITY), IN TORT (INCLUDING NEGLIGENCE), UNDER A WARRANTY, UNDER STATUTE OR OTHERWISE, EVEN IF NOTIFIED OF THE POSSIBILITY OF THE SUCH DAMAGES IN RESPECT OF ANY INACCURACIES, ERRORS OR OMISSIONS, OR ANY LOSS OR DAMAGE SUFFERED BY YOU AS A RESULT OF OR IN CONNECTION WITH THE S&P DATA CONTAINED HEREIN. ALL INTELLECTUAL PROPERTY AND OTHER PROPRIETARY RIGHTS COMPRISED IN THE S&P DATA ARE AND SHALL BE THE EXCLUSIVE PROPERTY OF S&P.

Indicative NAV per unit in SGD is for reference only and is calculated using the actual NAV per unit in USD converted into SGD, using the exchange rates quoted by Reuters at 4:00 p.m. (Hong Kong time) as of the same Dealing Day.

The Lion-China Merchants Emerging Asia Select Index ETF is the world’s first Emerging Asia ETF traded in SGD.

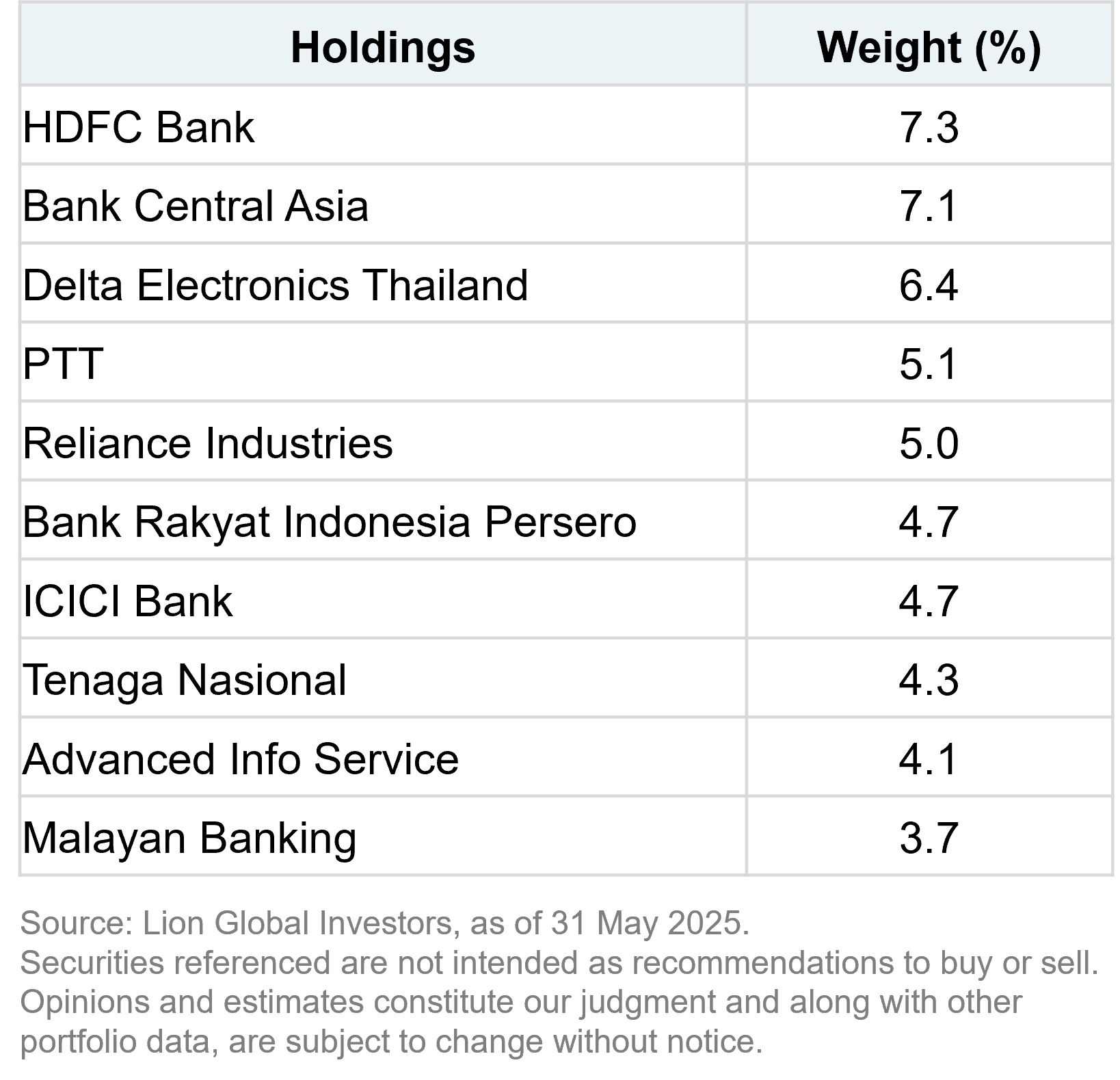

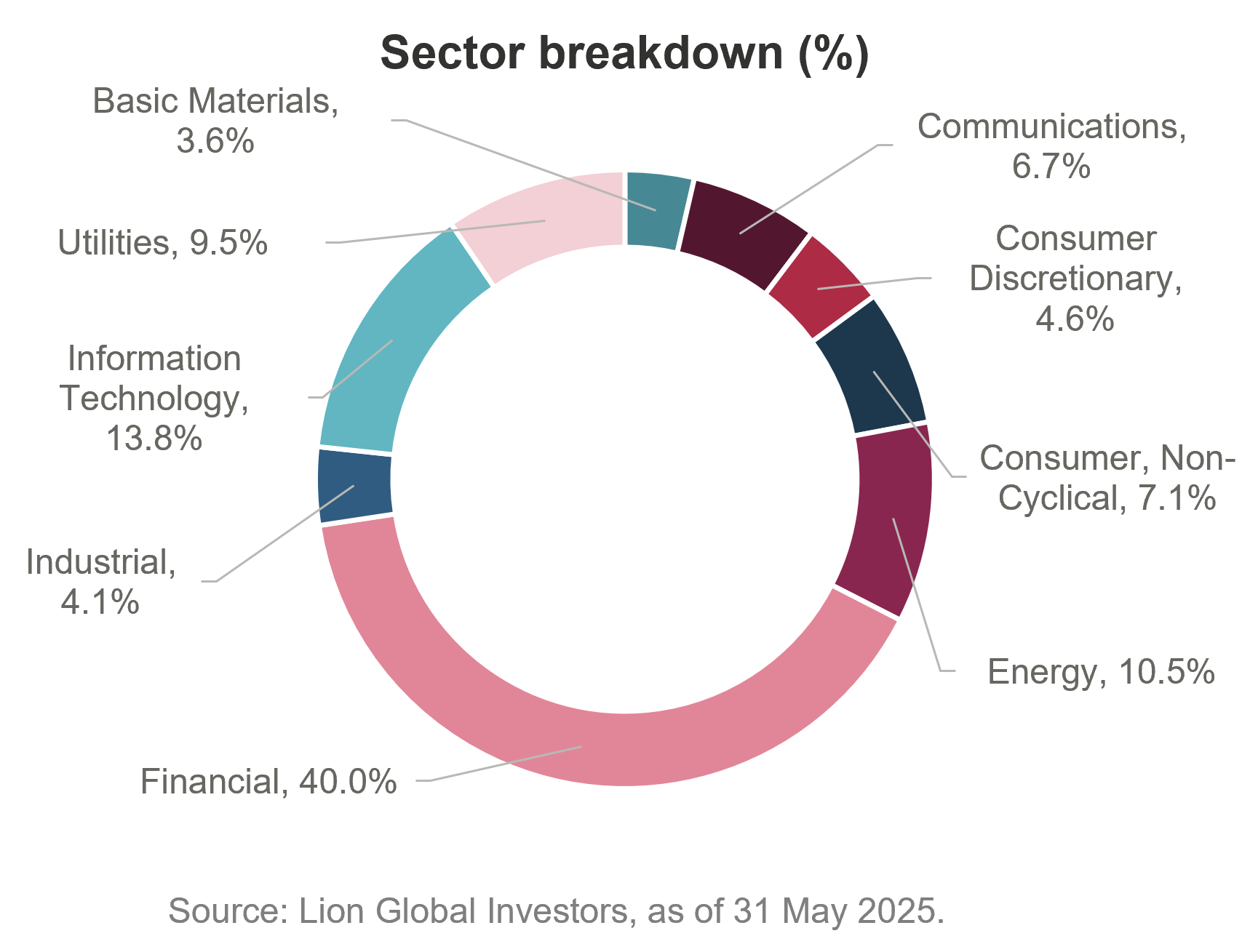

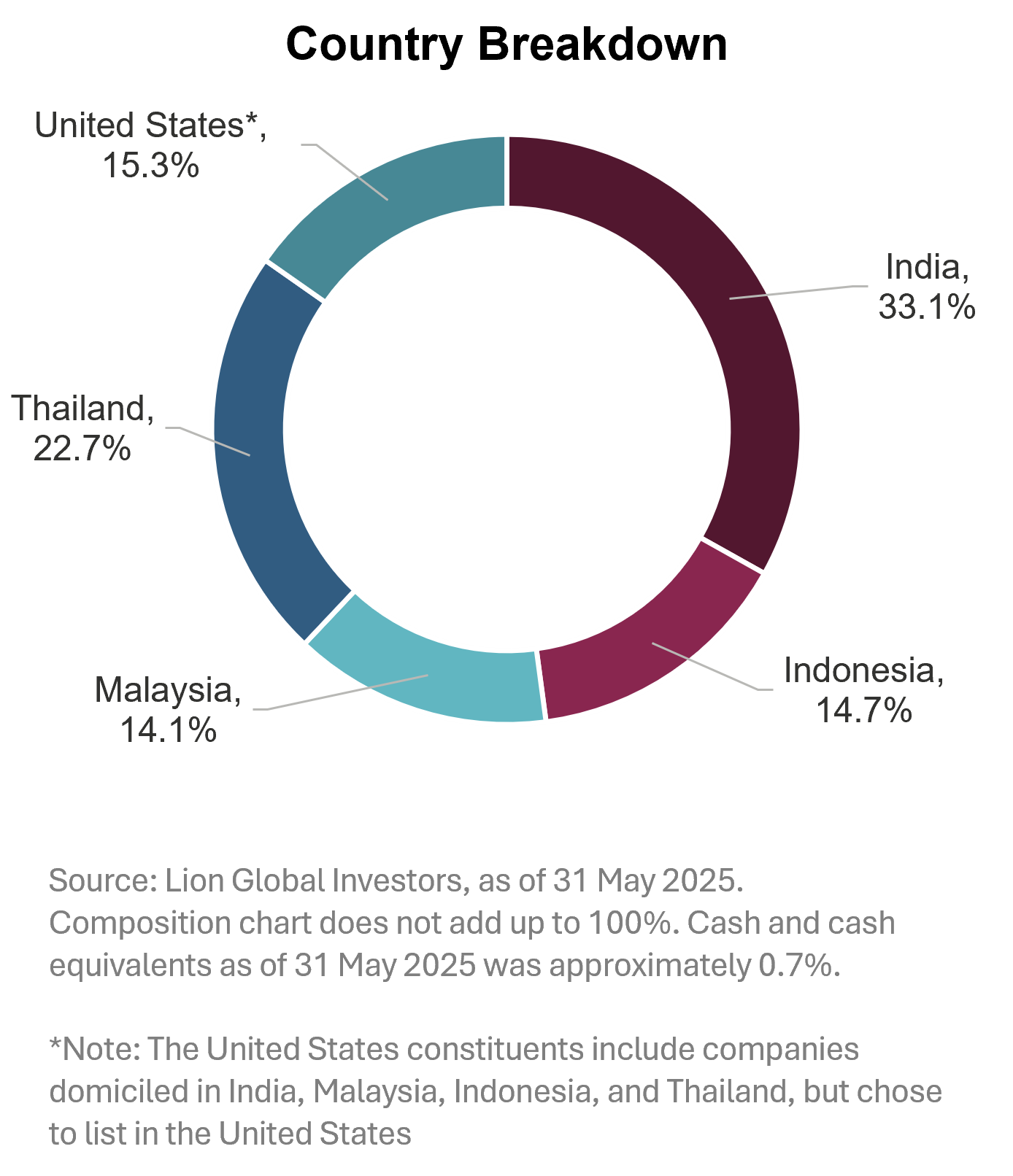

In collaboration with China Merchants Fund Management, the ETF helps investor build a diversified portfolio consisting of the 50 largest and most tradable companies domiciled in India, Malaysia, Indonesia and Thailand.

The investment objective of the Fund is to replicate as closely as possible, before expenses, the performance of the iEdge Emerging Asia Select 50 Index using a direct investment policy of investing in all, or substantially all, of the underlying Index Securities.

The Index is compiled and calculated by Singapore Exchange Limited. The Index aims to track the 50 largest and most tradable companies (i) domiciled in Emerging Asia countries; and (ii) listed in Emerging Asia countries or the US Exchanges, and is designed to provide access to growth in these Emerging Asia countries (i.e. India, Indonesia, Thailand and Malaysia).

Ride on the growth of India, Malaysia, Indonesia and Thailand (IMIT)

Naturally diversify across stocks, sectors and the 4 countries^ through the respective weightage caps of 7%, 40% and 50%

Build a portfolio consisting of the 50 largest and most tradable companies in IMIT

| As of | |

| Fund Listing Date | 11 December 2024 |

| Tracking Difference | |

| Tracking Error |

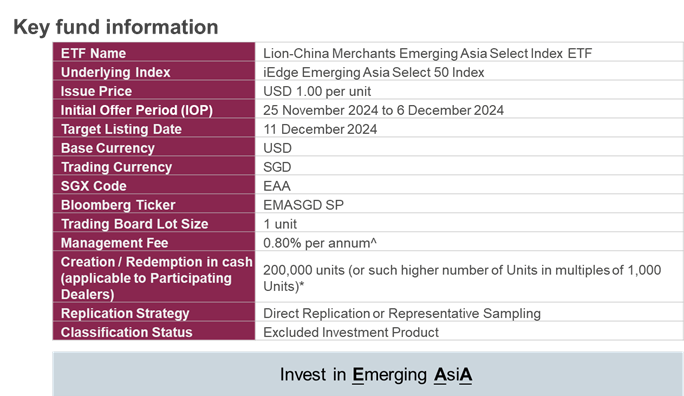

| Underlying Index | iEdge Emerging Asia Select 50 Index |

| Issue Price | USD 1.00 per unit |

| Base Currency | USD |

| Trading Currency | SGD, USD |

| SGX Code | EAA (SGD), EAU (USD) |

| Bloomberg Ticker | EMASGD SP (SGD), EMAUSD SP (USD) |

| ISIN | SGXC20553779 |

| Trading Board Lot Size | 1 unit |

| Management Fee |

Currently 0.80% p.a of the Net Asset Value of the Fund. Maximum 0.99% p.a of the Net Asset Value of the Fund. The Manager’s fee is retained by the Manager as the Manager |

| Creation / Redemption in cash (applicable to Paricipating Dealers) | 200,000 units (or such higher number of Units in multiples of 1,000 Units)* |

| Replication Strategy | Direct Replication or Representative Sampling |

| Classification Status | Excluded Investment Product |

| Designated Market Maker | Phillip Securities Pte Ltd, China Merchants Investment Management (HK) Co., Limited |

* Application Unit size is at the discretion of the Manager. Application Unit size may be less than 200,000 and in multiples of 1 Unit during the Initial Offer Period.

India, Malaysia, Indonesia and Thailand (IMIT) are anchored by favorable labor costs and business-friendly environments, positioning them to produce competitive exports and attract significant foreign direct investments. We believe these countries are the next Asian Tigers, poised to transform Asia's economic landscape.

Being emerging markets, these IMIT countries are naturally expected to achieve higher growth levels than developed markets like the US. Demographically, the IMIT countries are young, and they hence do not face the ageing population issues facing that impact the developed countries.

The Lion-China Merchants Emerging Asia Select Index ETF offers investors a unique opportunity to tap into the high-growth economies of Emerging Asia, specifically IMIT. This ETF provides a convenient way to gain exposure to these dynamic markets within a single investment vehicle.

Investing directly in stocks from IMIT countries can be challenging for many investors due to the time, expertise, and confidence required to select individual stocks in less familiar markets. Additionally, certain markets, like India, impose restrictions that prevent foreign individual investors from directly purchasing stocks.

While ETFs are a more accessible option, most emerging market ETFs are heavily weighted towards China, Taiwan, and South Korea, which may not align with investors seeking targeted exposure to IMIT countries. The Lion-China Merchants Emerging Asia Select Index ETF addresses this gap by offering focused exposure to the high-growth economies of IMIT, offering investors an opportunity to diversify their portfolios with markets that have potential for growth.

The constituents of the Lion-China Merchants Emerging Asia Select Index ETF are companies domiciled in India1, Malaysia, Indonesia, Thailand2, and listed in these countries or on US exchanges. New constituents must meet a minimum daily traded velocity threshold of 0.1%, while existing constituents must meet a threshold of 0.08%. Additionally, there is a Foreign-Ownership-Adjusted Free-Float threshold of 10% for new constituents and 8% for existing constituents.

The selection is based on the top 50 companies by Foreign-Ownership-Adjusted Free-Float Market Capitalisation, subject to buffer rules to control portfolio turnover. The ETF also adheres to the following caps:

- A 7% single stock weightage cap.

- A 40% sector weightage cap.

- A 50% country of domicile weightage cap.

1Accessed via the Bombay Stock Exchange.

2Non-Voting Depositary Receipts (NVDRs) only

The ETF tracks the index, which is rebalanced semi-annually in March and September.

The Lion-China Merchants Emerging Asia Select Index ETF is a collaboration between Lion Global Investors (an OCBC company) and China Merchants Fund Management (part of China Merchants Group). Lion Global Investors and China Merchants Fund Management believe in the growth potential of the IMIT economies and have created the ETF to offer investors targeted exposure in these high-growth markets. The collaboration aims to enhance the ETF’s outreach and appeal to investors.

The Lion-China Merchants Emerging Asia Select Index ETF Initial Offering Period (IOP) is from 25 November to 6 December 2024.

During the Initial Offer Period, you may subscribe via the following participating bank and dealers by the following dates:

|

Participating Banks/Dealers |

Subscription End Date |

How to subscribe |

|

OCBC ATM, Online and Mobile Banking |

Thu 5 Dec, 12pm |

|

|

OCBC Securities |

Tue 3 Dec, 12pm |

Subscribe via your Trading Representative (TR). Follow the below steps to find out the contact details of your TR. 1. Log in to the iOCBC Online Trading Platform 2. Click on ‘More’ at the top menu 3. Select ‘Account Details’ to view your TR’s contact details |

|

FSMOne |

Thu 5 Dec, 5pm |

|

|

Maybank Securities |

Tue 3 Dec, 4pm |

Login in to Maybank Trade Mobile App |

|

POEMS |

Thu 5 Dec, 5pm |

1. Login to your POEMS 2.0 account > Acct Mgt > Online Forms > IPO Subscription – Irrevocable Form 2. Select the IPO that you wish to subscribe to 3. Read and agree to the prospectus, terms and conditions before subscribing to the financial product 4. Ensure sufficient cash is present in your POEMS account to complete the application process (inclusive of subscription amount, transfer fee and GST) by the settlement date on Thu 5 Dec 2024, 5pm |

| Tiger Brokers | Thu 5 Dec, 5pm |

1. Log in to Tiger Trade 2. Go to Portfolio > More > IPO > SG 3. Select the IPO and place your Trade order |

Exclusive promotion during the Initial Offer Period

For POEMS customers:

- Get S$20 cash credits for every 10,000 units subscribed before 5 December 2024, 5pm.

- Limited to S$500 cash credits per customer. For the first 100 customers.

For OCBC ATM, Online and Mobile Banking:

- S$2 application fee waived

Once the ETF is listed on SGX at 11 December 2024, you may invest in the Lion-China Merchants Emerging Asia Select Index ETF via your broker who has access to SGX market. The SGD ticker is EAA.

With USD 1.00, Emerging Asia is within your reach. Access IMIT and make the right move in Emerging Asia.

^ Up to a maximum of 0.99% per annum of the Net Asset Value of the Fund

*Application Unit size is at the discretion of the Manager. Application Unit size may be less than 200,000 and in multiples of 1 Unit during the Initial Offer Period.

You can subscribe with SRS after the ETF is listed on SGX on 11 December 2024. As this is a new ETF, it needs a minimum track record before it can be CPFIS registered.

You can open a CDP account in https://www.sgx.com/securities/retail-investor/apply-cdp-securities-account

^Refers to OCBC Securities Private Limited

**Subscribe by 5 December 2024 12pm at SGD 2 application fee (waived). Terms and conditions apply.

Webinar & Physical Event

Date: Tue, 26 Nov 2024

Time: 7:00PM - 8:00PM (Singapore)

Webinar & Physical Event

Date: Wed, 27 Nov 2024

Time: 12:00PM - 1:00PM (Singapore)

Disclaimer – Lion-China Merchants Emerging Asia Select Index ETF

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. It is for information only, and is not a recommendation, offer or solicitation for the purchase or sale of any capital markets products or investments and does not have regard to your specific investment objectives, financial situation, tax position or needs. You should read the prospectus and Product Highlights Sheet of the Lion-China Merchants Emerging Asia Select Index ETF (“ETF”), which is available and may be obtained from Lion Global Investors Limited (“LGI”) or any of the its distributors and appointed Participating Dealers (“PDs”), for further details including the risk factors and consider if the ETF is suitable for you and seek such advice from a financial adviser if necessary, before deciding whether to purchase units in the ETF.

Investments in the ETF are not obligations of, deposits in, guaranteed or insured by LGI or any of its affiliates and are subject to investment risks including the possible loss of the principal amount invested. The performance of the ETF is not guaranteed and, the value of its units and the income accruing to the units, if any, may rise or fall. Past performance, payout yields and payments, as well as, any prediction, projection, or forecast are not necessarily indicative of the future or likely performance, payout yields and payments of the ETF. Any extraordinary performance may be due to exceptional circumstances which may not be sustainable. Dividend distributions, which may be either out of income and/or capital, are not guaranteed and subject to LGI’s discretion. Any such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value of the ETF. Any references to specific securities are for illustration purposes and are not to be considered as recommendations to buy or sell the securities. It should not be assumed that investment in such specific securities will be profitable. There can be no assurance that any of the allocations or holdings presented will remain in the ETF at the time this information is presented. Any information (which includes opinions, estimates, graphs, charts, formulae or devices) is subject to change or correction at any time without notice and is not to be relied on as advice. You are advised to conduct your own independent assessment and investigation of the relevance, accuracy, adequacy and reliability of any information or contained herein and seek professional advice on them. No warranty is given and no liability is accepted for any loss arising directly or indirectly as a result of you acting on such information. The ETF may, where permitted by the prospectus, invest in financial derivative instruments for hedging purposes or for efficient portfolio management. The ETF’s net asset value may have higher volatility as a result of its narrower investment focus on Emerging Asia countries, when compared to funds investing in developed markets. LGI, its related companies, their directors and/or employees may hold units of the ETF and be engaged in purchasing or selling units of the ETF for themselves or their clients.

The units of the ETF are listed and traded on the Singapore Exchange Securities Trading Limited (“SGX-ST”), and may be traded at prices different from its net asset value, suspended from trading, or delisted. Such listing does not guarantee a liquid market for the units. You cannot purchase or redeem units in the ETF directly with the manager of the ETF, but you may, subject to specific conditions, do so on the SGX-ST or through the PDs.

© Lion Global Investors Limited (UEN/ Registration No. 198601745D). All rights reserved. LGI is a Singapore incorporated company and is not related to any corporation or trading entity that is domiciled in Europe or the United States (other than entities owned by its holding companies).

Disclaimer – Singapore Exchange Limited for iEdge Emerging Asia Select 50 Index

The units of the Lion-China Merchants Emerging Asia Select Index ETF are not in any way sponsored, endorsed, sold or promoted by the Singapore Exchange Limited (“SGX”) and/or its affiliates and SGX and/or its affiliates make no warranty or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the iEdge Emerging Asia Select 50 Index and/or the figure at which the iEdge Emerging Asia Select 50 Index stands at any particular time on any particular day or otherwise. The iEdge Emerging Asia Select 50 Index is administrated, calculated and published by SGX. SGX shall not be liable (whether in negligence or otherwise) to any person for any error in the Lion-China Merchants Emerging Asia Select Index ETF and the iEdge Emerging Asia Select 50 Index and shall not be under any obligation to advise any person of any error therein.

Intellectual property rights in the iEdge Emerging Asia Select 50 Index vest in SGX. The iEdge Emerging Asia Select 50 Index is used by Lion Global Investors Limited under licence.

Disclaimer – China Merchants Fund Management Company Limited

The references to the company name and logo of China Merchants Fund Management Company Limited in this material do not constitute a guarantee by China Merchants Fund Management Company Limited of the authenticity, accuracy and completeness of the relevant content, nor do they constitute a judgment or guarantee by China Merchants Fund Management Company Limited of the investment value and performance of the Lion-China Merchants Emerging Asia Select Index ETF. China Merchants Fund Management Company Limited assumes no liability for this material or the investors’ investment in the Lion-China Merchants Emerging Asia Select Index ETF.

.png)