Disclaimer - Lion Global Investors Limited

The IntraDay Indicative NAV (iNAV) shown is provided by S&P Global Limited (“S&P”). The iNAV is indicative and for reference purposes only. It may differ from the actual NAV calculated in accordance with the Trust Deed and should not be viewed as the actual NAV. Please refer to the actual NAV as published above under “NAV”.

Disclaimer - S&P

Neither S&P, its affiliates nor any of its third party data providers makes any representation or warranty, express or implied, as to the accuracy, completeness or timeliness of the data contained herein nor as to the results to be obtained by recipients. S&P is not responsible for and has not participated in the determination of the prices and amount of the Fund or the timing of the issuance or sale of the Units of the Fund or in the determination or calculation of the equation by which Units of the Fund are converted into cash. S&P has no obligation or liability in connection with the administration, marketing or trading of the Fund. Furthermore, S&P has no obligation to update, modify or amend this data or to otherwise notify a recipient if any data changes or subsequently becomes inaccurate. THE INAV IS NOT, AND SHOULD NOT BE TAKEN OR RELIED ON AS BEING, THE NET ASSET VALUE PER UNIT OR THE PRICE AT WHICH UNITS MAY BE SUBSCRIBED FOR OR REDEEMED THROUGH A PARTICIPATING DEALER OR PURCHASED OR SOLD ON THE SGX-ST. NO ASSURANCE CAN BE GIVEN THAT THE INAV WILL BE UP TO DATE AT ALL TIMES OR FREE FROM ERROR. WITHOUT LIMITING THE FOREGOING, NEITHER S&P, ITS AFFILIATES NOR ANY THIRD PARTY DATA PROVIDER SHALL HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), WHATSOEVER TO YOU, WHETHER IN CONTRACT (INCLUDING UNDER AN INDEMNITY), IN TORT (INCLUDING NEGLIGENCE), UNDER A WARRANTY, UNDER STATUTE OR OTHERWISE, EVEN IF NOTIFIED OF THE POSSIBILITY OF THE SUCH DAMAGES IN RESPECT OF ANY INACCURACIES, ERRORS OR OMISSIONS, OR ANY LOSS OR DAMAGE SUFFERED BY YOU AS A RESULT OF OR IN CONNECTION WITH THE S&P DATA CONTAINED HEREIN. ALL INTELLECTUAL PROPERTY AND OTHER PROPRIETARY RIGHTS COMPRISED IN THE S&P DATA ARE AND SHALL BE THE EXCLUSIVE PROPERTY OF S&P.

*Indicative NAV

Indicative NAV per unit in CNH is for reference only and is calculated using the last NAV per unit in SGD converted into CNH, using the exchange rates quoted by Reuters at 3:00 p.m. (Hong Kong time) as of the same Dealing Day.

The Lion-China Merchants CSI Dividend Index ETF is the first CSI Dividend Index ETF listed outside Mainland China.

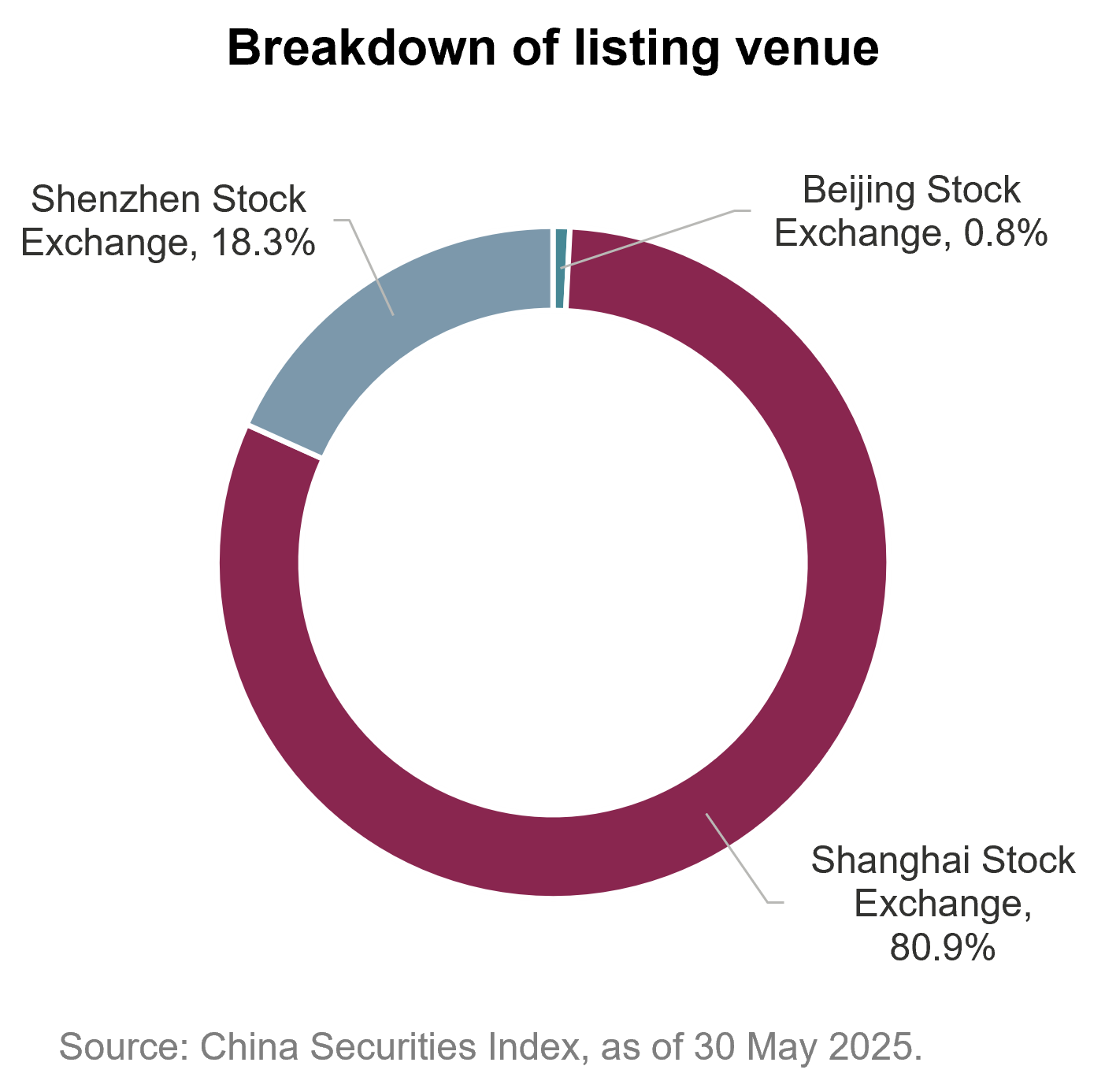

In collaboration with China Merchants Fund Management, the ETF helps investors build a diversified portfolio consisting of 100 Shanghai-listed or Shenzhen-listed A shares with high cash dividend yields, stable dividends and a certain scale and liquidity.

The investment objective of the Fund is to track as closely as possible, before fees and expenses, the performance of the CSI Dividend Index ("Index"), by investing in units of the China Merchants CSI Dividend ETF (the "Underlying Fund").

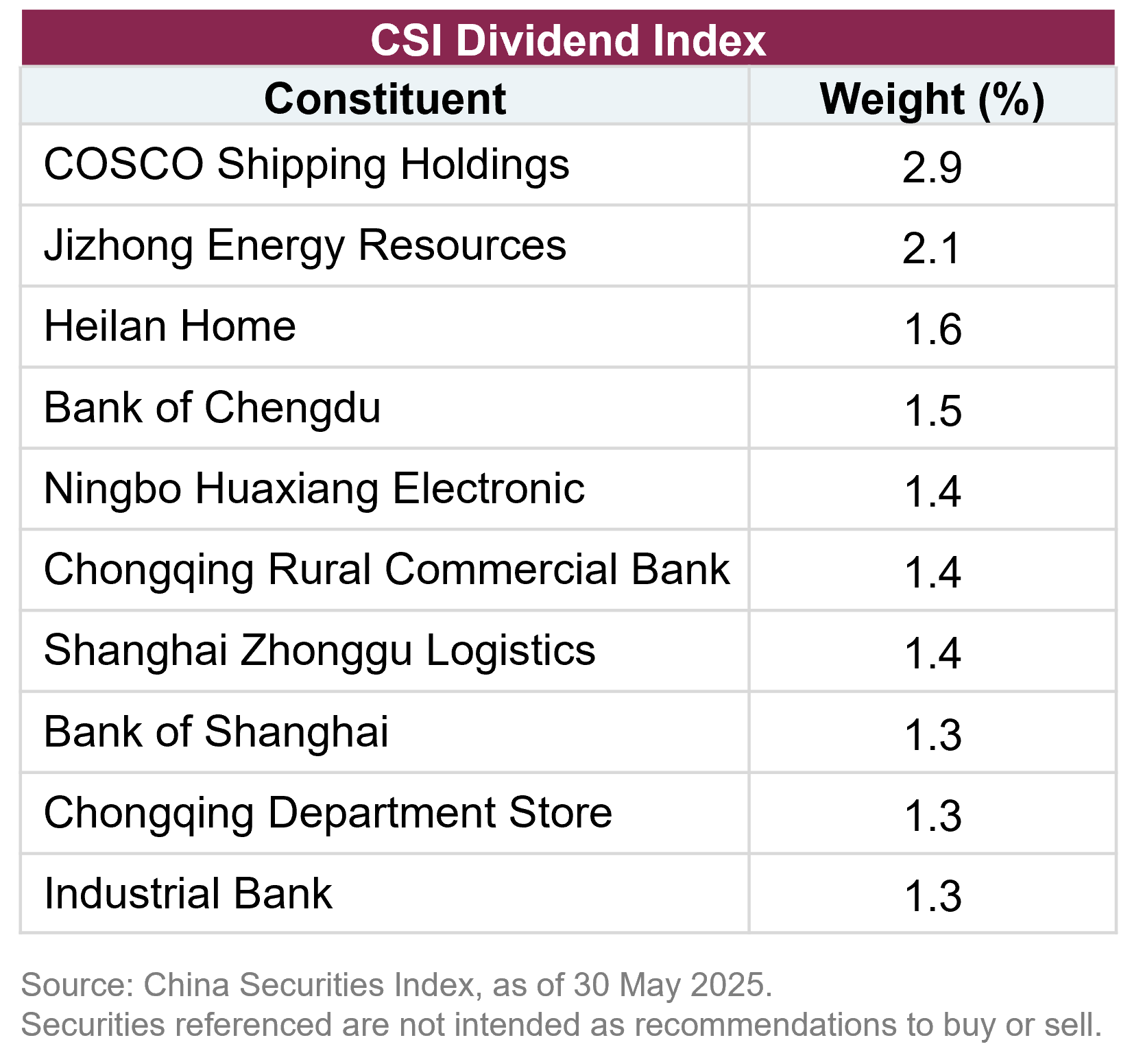

The Index comprises 100 Shanghai-listed or Shenzhen-listed A shares with (i) high cash dividend yields, (ii) stable dividends and (iii) a certain scale and liquidity, weighted based on their dividend yields to reflect the overall performance of the high-dividend stocks in the A-share market.

The Index focuses on companies with a proven track record of consistent dividend payments at least in the past 3 years

Companies are selected based on their robust financial health. These companies typically have strong cash flows and high free cash flow to dividend coverage ratios

This ETF helps investors access a diversified portfolio of dividend-paying stocks, generating a passive income stream

| As of | |

| Fund Listing Date | 28 March 2025 |

| Tracking Difference | |

| Tracking Error |

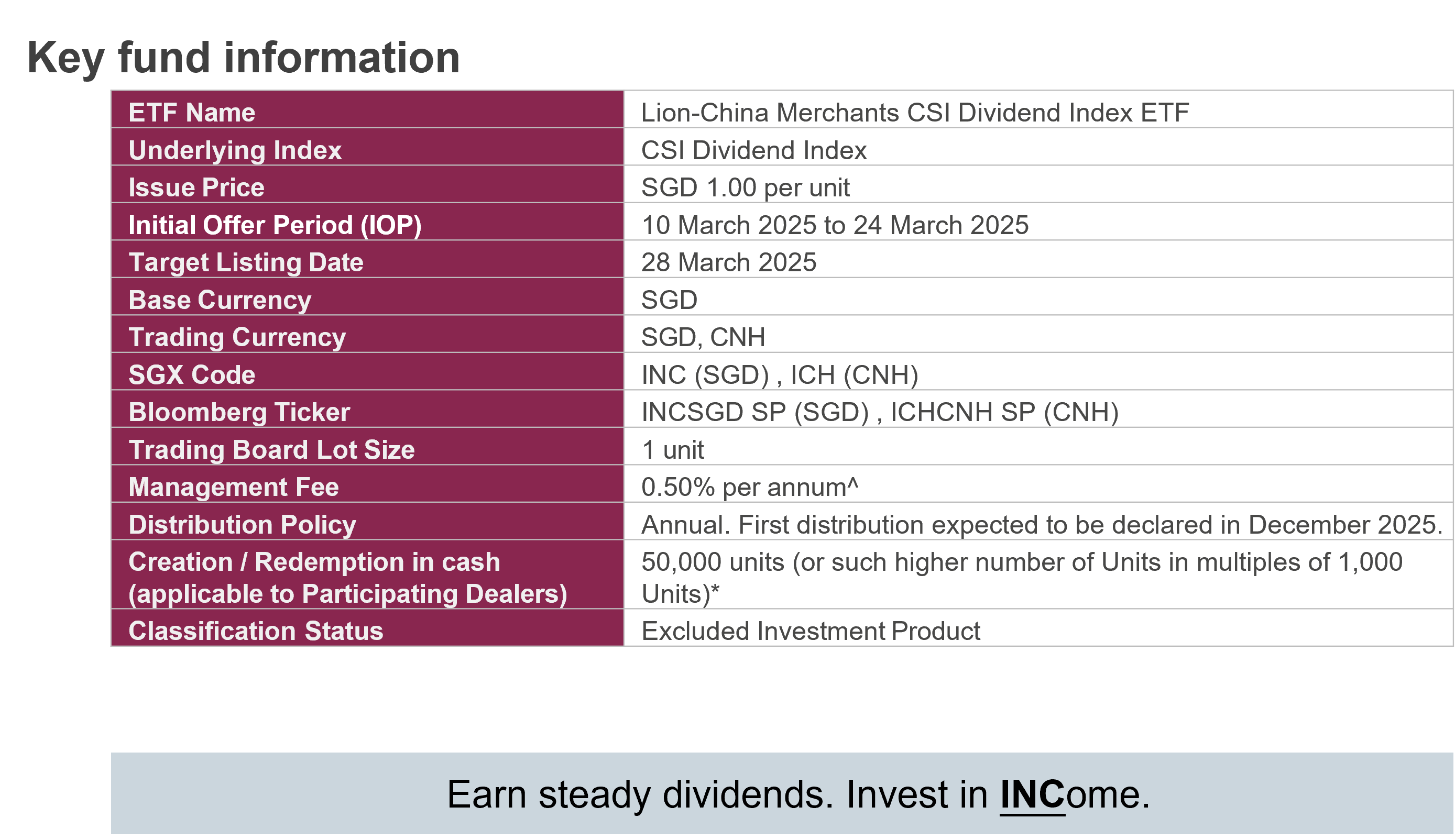

| Underlying Index | CSI Dividend Index |

| Listing Date | 28 March 2025 |

| Issue Price | SGD 1.00 per unit |

| Initial Offer Period (IOP) | 10 March 2025 to 24 March 2025 |

| Base Currency | SGD |

| Trading Currency | SGD, CNH |

| SGX Code | INC (SGD), ICH (CNH) |

| Bloomberg Ticker | INCSGD SP (SGD), ICHCNH SP (CNH) |

| ISIN | SGXC45242093 |

| Trading Board Lot Size | 1 unit |

| Management Fee |

Currently 0.50% p.a of the Net Asset Value of the Fund. Maximum 0.99% p.a of the Net Asset Value of the Fund. The Manager’s fee is retained by the Manager as the Manager does not pay any trailer fees with respect to the Fund. |

| Dividend Frequency^ | Annual. First distribution expected to be declared in December 2025. |

| Creation / Redemption in cash (applicable to Paricipating Dealers) | 50,000 units (or such higher number of Units in multiples of 1,000 Units)* |

| Classification Status | Excluded Investment Product |

| Designated Market Maker | Phillip Securities Pte Ltd, China Merchants Securities Investment Management (HK) Co., Limited |

^Distributions are not guaranteed and may fluctuate. Past distributions are not necessarily indicative of future payments. Distribution payouts and its frequency might be changed at the Manager's discretion and can be made out of income, capital or both. Any payment of distributions by the fund may result in an immediate reduction of the net asset value per share/unit. Please refer to our website for more information on the income disclosures.

China is the world’s second largest economy and Asia Pacific’s largest economy. With China’s 10-year government bond yield recently reaching an all-time low 1.77% on 28 February 2025 (Source: Bloomberg, 28 February 2025), it marks an increasing equity risk premium (ERP), enhancing its attractiveness over bonds and US equities. Spikes in the ERP often precede equity rallies in China. This was recently observed in the September 2024 rally, following decade-high levels of the equity risk premium in August 2024.

With China’s leaders recently pledging to continue supporting the economy in 2025, there’s upside potential to be captured for Chinese equities.

The Lion-China Merchants CSI Dividend Index ETF offers investors a unique opportunity to invest in a diversified portfolio of 100 Shanghai-listed or Shenzhen-listed A shares with track record of high and stable dividends. Dividends help investors lock in capital gains.

The constituents of the Lion-China Merchants CSI Dividend Index ETF are securities that are in the top 80% of the average daily total market capitalization and average daily trading value in the past year. Additionally, they must have continuously paid cash dividends with an average payout ratio in the past three years and the payout ratio in the last year are both between 0 and 1.

The selection is by ranking eligible securities by average cash dividend yield over the past three years and selecting the top 100. Each constituent’s weight is capped at 10% and constituents with a total market value of less than RMB 10 billion are capped at 0.5%.

The ETF tracks the Index, which is rebalanced annually in December.

The Lion-China Merchants Emerging Asia Select Index ETF is a collaboration between Lion Global Investors (an OCBC company) and China Merchants Fund Management (part of China Merchants Group). The collaboration aims to provide investors access to China’s growth story while receiving high dividends.

The Lion-China Merchants CSI Dividend Index ETF's Initial Offering Period (IOP) is from 10 March to 24 March 2025.

During the Initial Offer Period, you may subscribe via the following participating bank and dealers by the following dates:

|

Participating Banks/Dealers |

Subscription End Date |

How to subscribe |

|

OCBC ATM, Online and Mobile Banking |

Fri 21 Mar, 12pm |

|

|

OCBC Securities |

Wed 19 Mar, 12pm |

Subscribe via your Trading Representative (TR). Follow the below steps to find out the contact details of your TR. 1. Log in to the iOCBC Online Trading Platform 2. Click on ‘More’ at the top menu 3. Select ‘Account Details’ to view your TR’s contact details |

|

FSMOne |

Mon 24 Mar, 9.30am |

1. Clients to fund their Multi-Currency Cash Account for the total subscription amount including the processing fees and GST of 9%. 2. Login to FSMOne.com and proceed to subscribe online: · Select Live Trading > Stocks & ETFs > IPOs/Placements · Indicate your quantity of shares and select the payment method · Read and acknowledge the declaration · Key in password and click submit 3. Upon the completion of the IOP subscription, clients will receive an acknowledgment email regarding the IOP subscription order. 4. Upon the completion of the allocation, FSMOne will notify clients of the final allocation results. 5. FSMOne will send clients a subscription confirmation email once the details are confirmed by our dealers. 6. The allotment for this issue will be in full, subject to receipt and clearance of subscription monies. There will be no balloting. |

|

Maybank Securities |

Wed 19 Mar, 12pm |

Please approach your Trading Representatives. |

|

POEMS |

Fri 21 Mar, 5pm |

|

| Tiger Brokers | Fri 21 Mar, 5pm |

|

For OCBC ATM, Online and Mobile Banking:

- S$2 application fee waived

Exclusive promotion during the Initial Offer Period

For POEMS customers:

- Get S$12 cash credits for every SGD5,000 invested before 21 March 2025, 5pm.

- Limited to S$600 cash vouchers per customer. For the first 500 customers.

- Client must hold investment in the Fund for a minimum holding period of one (1) month from 28 March 2025, the listing date of the Fund (i.e. until 27 April 2025) (the “Minimum Holding Period”). This cash credit will be credited to the eligible clients’ POEMS account after the Minimum Holding Period.

For Tiger Brokers customers:

- Get S$12 cash coupon for every SGD5,000 invested before 21 March 2025, 5pm.

- Limited to S$600 cash coupons per customer. For the first S$2.5 million in total subscriptions received by Tiger Brokers Singapore or the first 500 customers, whichever comes first.

- Client must hold investment in the Fund for a minimum holding period of one (1) month from 28 March 2025, the listing date of the Fund (i.e. until 27 April 2025) (the “Minimum Holding Period”). This cash credit will be credited to the eligible clients’ Tiger Brokers Singapore account after the Minimum Holding Period.

^ Up to a maximum of 0.99% per annum of the Net Asset Value of the Fund

*Application Unit size is at the discretion of the Manager. Application Unit size may be less than 50,000 and in multiples of 1 Unit during the Initial Offer Period.

Once the ETF is listed on SGX at 28 March 2025, you may invest in the Lion-China Merchants CSI Dividend Index ETF via your broker who has access to SGX market. The SGD tickers are INC (SGD counter) and ICH (CNH counter).

You can subscribe with SRS after the ETF is listed on SGX on 28 March 2025. As this is a new ETF, it needs a minimum track record before it can be CPFIS registered.

*References to specific corporations/companies and their trademarks are not intended as recommendations to purchase or sell investments in such corporations/companies nor do they directly or indirectly express or imply any sponsorship, affiliation, certification, association, approval, connection or endorsement between any of these corporations/companies and Lion Global Investors Limited or the products and services of Lion Global Investors Limited.

^Refers to OCBC Securities Private Limited.

**Subscribe by 21 March 2025 12pm at SGD 2 application fee (waived). Terms and conditions apply.

Webinar & Physical Event

Date: Mon, 10 Mar 2025

Time: 7:00PM - 8:00PM (Singapore)

Webinar

Date: Thu, 13 Mar 2025

Time: 7:00PM - 8:00PM (Singapore)

Webinar & Physical Event

Date: Tue, 18 Mar 2025

Time: 12:00PM - 1:00PM (Singapore)

Disclaimer – Lion-China Merchants CSI Dividend Index ETF

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. It is for information only, and is not a recommendation, offer or solicitation for the purchase or sale of any capital markets products or investments and does not have regard to your specific investment objectives, financial situation, tax position or needs. You should read the prospectus and Product Highlights Sheet of the Lion-China Merchants CSI Dividend Index ETF (“ETF”), which is available and may be obtained from Lion Global Investors Limited (“LGI”) or any of the its distributors and appointed Participating Dealers (“PDs”), for further details including the risk factors and consider if the ETF is suitable for you and seek such advice from a financial adviser if necessary, before deciding whether to purchase units in the ETF.

Investments in the ETF are not obligations of, deposits in, guaranteed or insured by LGI or any of its affiliates and are subject to investment risks including the possible loss of the principal amount invested. The performance of the ETF is not guaranteed and, the value of its units and the income accruing to the units, if any, may rise or fall. Past performance, payout yields and payments, as well as, any prediction, projection, or forecast are not necessarily indicative of the future or likely performance, payout yields and payments of the ETF. Any extraordinary performance may be due to exceptional circumstances which may not be sustainable. Dividend distributions, which may be either out of income and/or capital, are not guaranteed and subject to LGI’s discretion. Any such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value of the ETF. Any references to specific securities are for illustration purposes and are not to be considered as recommendations to buy or sell the securities. It should not be assumed that investment in such specific securities will be profitable. There can be no assurance that any of the allocations or holdings presented will remain in the ETF at the time this information is presented. Any information (which includes opinions, estimates, graphs, charts, formulae or devices) is subject to change or correction at any time without notice and is not to be relied on as advice. You are advised to conduct your own independent assessment and investigation of the relevance, accuracy, adequacy and reliability of any information or contained herein and seek professional advice on them. No warranty is given and no liability is accepted for any loss arising directly or indirectly as a result of you acting on such information. The ETF may, where permitted by the prospectus, invest in financial derivative instruments for hedging purposes or for efficient portfolio management. LGI, its related companies, their directors and/or employees may hold units of the ETF and be engaged in purchasing or selling units of the ETF for themselves or their clients.

The units of the ETF are listed and traded on the Singapore Exchange Securities Trading Limited (“SGX-ST”), and may be traded at prices different from its net asset value, suspended from trading, or delisted. Such listing does not guarantee a liquid market for the units. You cannot purchase or redeem units in the ETF directly with the manager of the ETF, but you may, subject to specific conditions, do so on the SGX-ST or through the PDs.

© Lion Global Investors Limited (UEN/ Registration No. 198601745D). All rights reserved. LGI is a Singapore incorporated company and is not related to any corporation or trading entity that is domiciled in Europe or the United States (other than entities owned by its holding companies).

Disclaimer – China Securities Index Co., Ltd.

All rights in the CSI Dividend Index (“Index”) vest in China Securities Index Co., Ltd. (“CSI”). CSI does not make any warranties, express or implied, regarding the accuracy or completeness of any data related to the Index. CSI is not liable to any person for any error of the Index (whether due to negligence or otherwise), nor shall it be under any obligation to advise any person of any error therein. The Fund based on the Index is in no way sponsored, endorsed, sold or promoted by CSI and CSI shall not have any liability with respect thereto.

Disclaimer – China Merchants Fund Management Company Limited

The references to the company name and logo of China Merchants Fund Management Company Limited in this material do not constitute a guarantee by China Merchants Fund Management Company Limited of the authenticity, accuracy and completeness of the relevant content, nor do they constitute a judgment or guarantee by China Merchants Fund Management Company Limited of the investment value and performance of the Lion-China Merchants CSI Dividend Index ETF. China Merchants Fund Management Company Limited assumes no liability for this material or the investors’ investment in the Lion-China Merchants CSI Dividend Index ETF.

Past performances of China Merchants CSI Dividend ETF and CSI Dividend Index neither are indicative of their future performances, nor constitute a guarantee of investment returns or any investment advice. Investing in funds involves risks, and caution is advised.

.png)